Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Despite year-on-year slides in four of the six largest national markets, Europe’s all-electric new sales grew again in November

Europe’s medium-sized BEV markets proved to be the saviour for continuing momentum in November, according to the latest data from lobby group the European Automobile Manufacturers’ Association, or Acea.

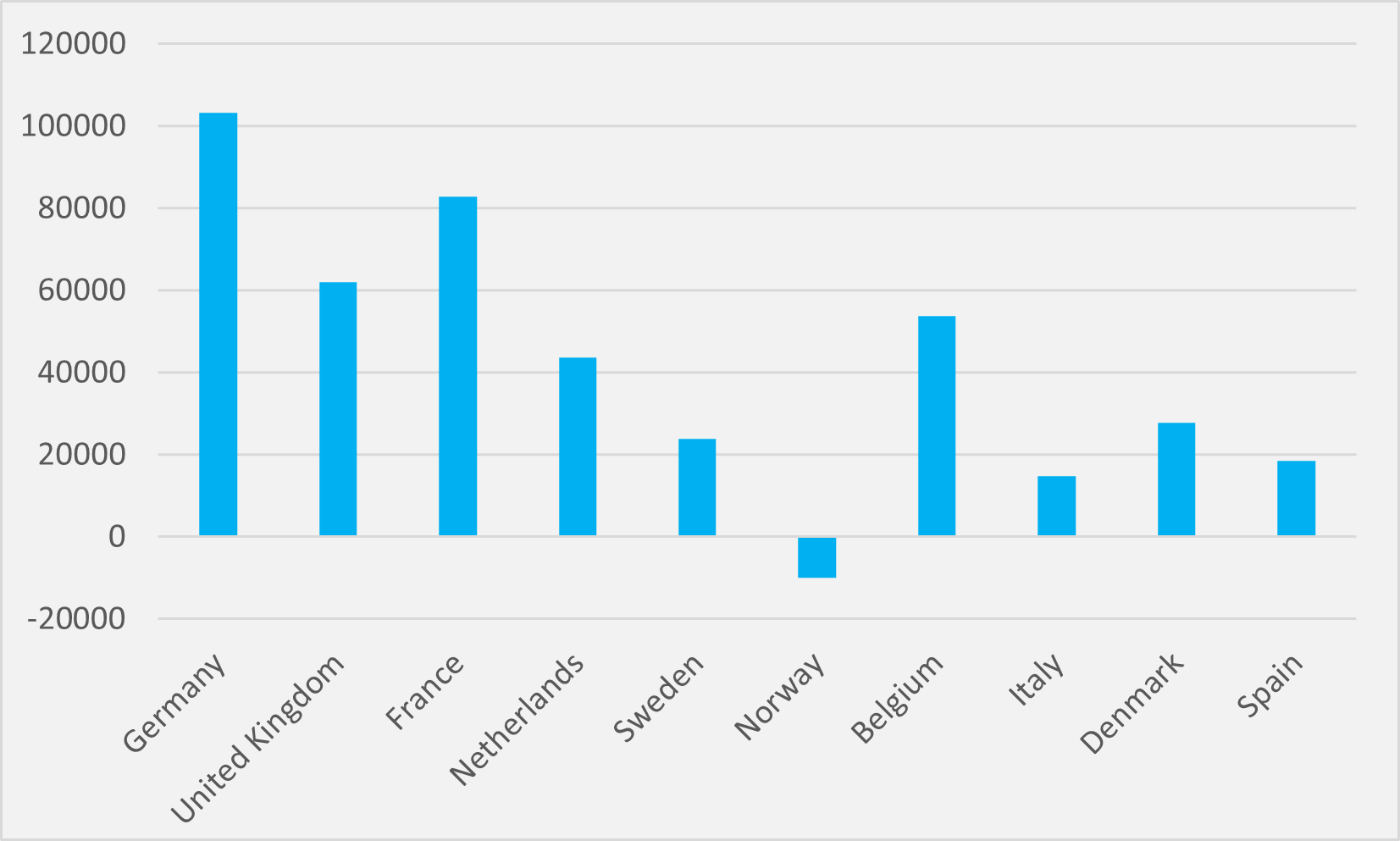

Already flagged year-on-year falls in some of the continent’s largest markets, such as Germany, the UK and Norway, had suggested growth could have been squeezed entirely in November.

But it was also already known that new BEV sales in France, Europe’s third largest market, had remained buoyant. And even though another material market in Sweden recorded a slight month-on-month decline, new sales were up across slew of other countries, including the Netherlands, Belgium, Italy, Denmark, Spain, Austria and Switzerland (see main image).

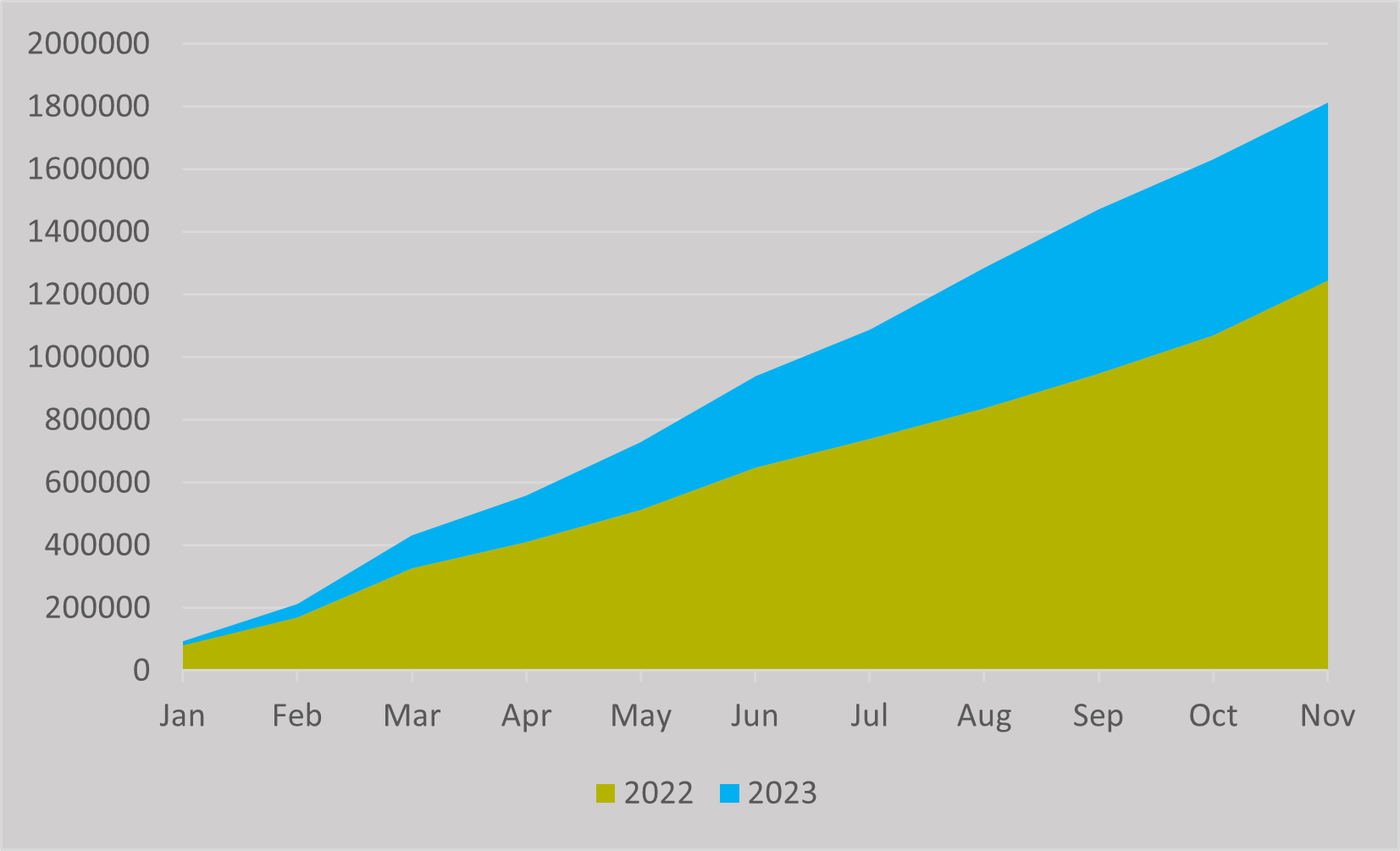

And all that saw November BEV sales for the 31-country EU+Efta+UK bloc hit almost 183,000, up by c.8,500 compared to November 2022. For the first 11 months of the year, the bloc has now seen new BEV sales of over 1.8mn, a rise of 570,000 compared to the same period last year (see Fig.1).

Every major national market barring Norway remains well ahead of last year on a cumulative basis (see Fig.2).

December at least matching November’s sales should be a given, based on the usual end-of-year spike in purchases. But there may be drags this particular December because of an abrupt end to German subsidies and the impending start of the ZEV Mandate in the UK which might encourage OEMs to push completed deals into January if possible.

Even so, it seems likely that December has good chance of recording the c.186,500 new BEV sales it needs to see Europe hit 2mn cumulative sales for 2023 as a whole. Whether Germany alone will hit half-a-million might be more touch-and-go, despite having topped 355,00 as far back as the end of August.

Some national markets remain on course for doubling last year’s efforts. Belgium is probably there already, no matter how many new BEVs sell in December, given its Jan-Nov sales ae above 85,000, having sold less than 35,000 in the same period last year.

Denmark and Portugal are two other markets where 2023 new sales thus far outstrip 2022 by more than 2-1. Other countries maintaining breakneck year-on-year growth are the Netherlands (up by 73pc on a cumulative basis) and Spain, something of a neglected success story with 69pc year-on-year growth.

Insider Focus LTD (Company #14789403)