Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

First drop in over three years adds to concerns over plateauing growth

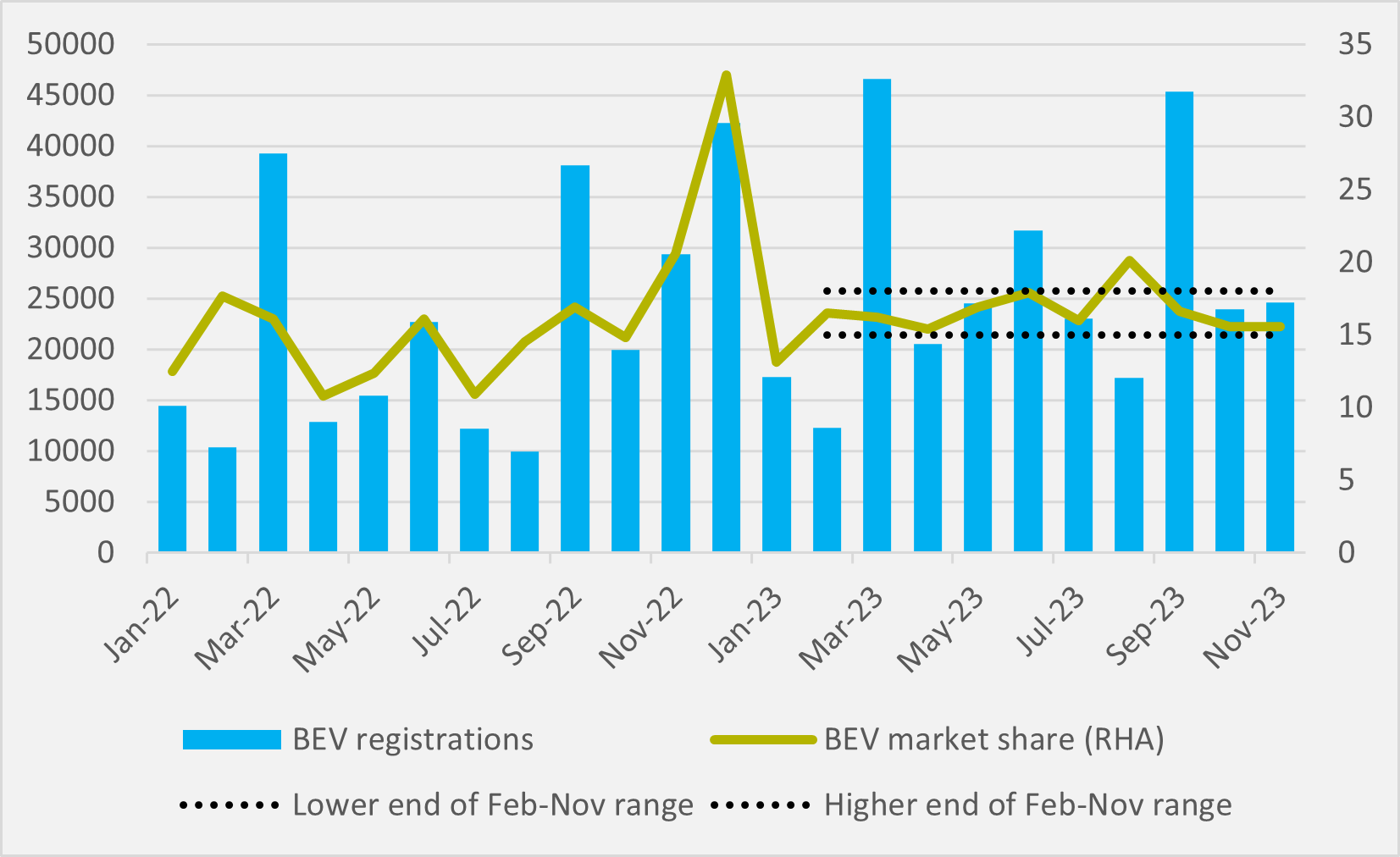

UK new BEV sales fell in November compared to the same month of 2022, according to new data from lobby group the Society of Motor Manufacturers and Traders (SMMT). New registrations dropped by 17.1pc year-on-year (see main image), while BEV market share also fell from 20.6pc in 2022 to 15.6pc in 2023.

But the country’s EV optimists are keen to stress that one monthly decline does not represent a fall in overall BEV buying appetite, more a slowing of previously breakneck growth.

“For the first time in about 40 months, the BEV registrations dropped in absolute terms compared to the same time last year,” says David Watts, EV fleet product manager at Volkswagen Financial Services “However, the market share at 15.6pc — whilst lower than last year — is still consistent with how BEVs have performed all year.”

Similarly to the US and Europe as a whole, UK EV penetration rates have been largely rangebound with the odd monthly exception since February — with an overall growing market pushing outright BEV sales higher. For the UK this has been a 15-18pc range with a spike in August (see Fig.1).

And the SMMT also offers reasons to be optimistic, chiefly that the year-on-year decline is relative to a peculiarly strong month for BEV sales in November ’22 which saw “significant deliveries following supply chain disruptions”. Watts also suggests November ’22 could be “a blip in the cycle”.

A month-on-month increase in BEV registrations, despite the year-on-year decline, could support this explanation — albeit month-on-month growth was only 3pc.

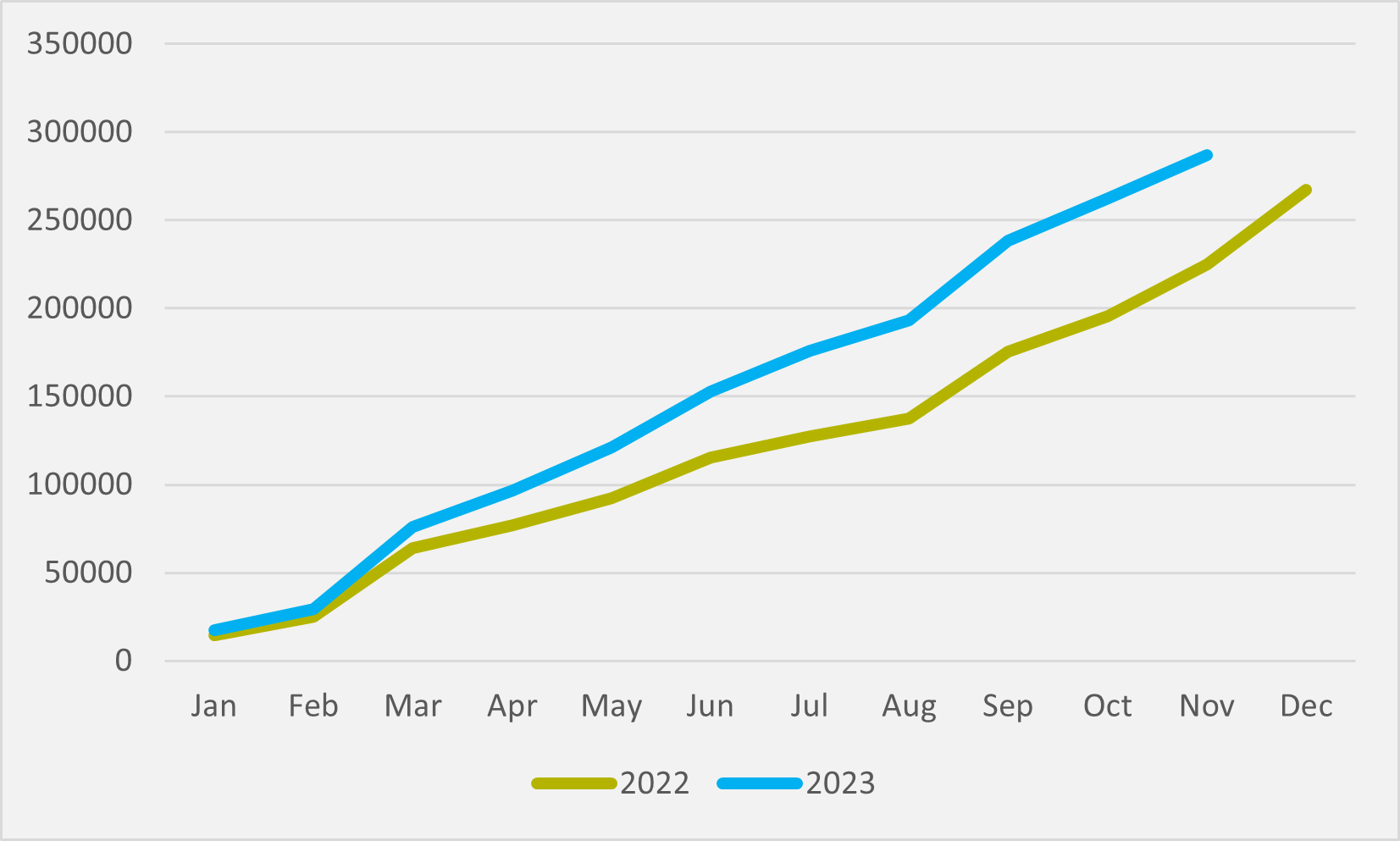

Secondly, year-to date BEV uptake is up by 27.5pc (see Fig.2), with a 16.3pc market share that SMMT expects to rise to 22.3pc next year. That said, at the end of August, the year-to-date advantage over 2002 stood at over 40pc. And December ’22 saw a traditional end-of-year sales spike to over 40,000 new BEVs shifted that has been matched by only two months of 2023 thus far, which could further compress 2023’s advantage in its final month.

“We are still on track to comfortably break the 300,000 milestone, although hitting 320,000 is looking a little more challenging now,” Watts notes. Year-to-date new BEV registrations stood just shy of 290,000 by the end of November.

Sluggishness

“The year-to-date figure is not following the trajectory we want because retail demand has been a lot slower this year. The BEV percentage of new car enquiries to retailers from Auto Trader has hovered around 15pc for most of 2023, whereas it was over 25pc last summer,” Marc Palmer, head of strategy and insights at online marketplace Autotrader says.

But with the UK’s freshly passed Zero Zemissions Vehicle (ZEV) mandate coming into force in January — which requires that 17pc of vehicles sold by automakers in 2024 are ZEVs or face being fined – Watts queries if “manufacturers [are] holding back deliveries with the 2024 mandate in mind and so we will see a surge in registrations in January”.

“Manufacturers may be holding back some registrations,” Palmer admits, but he still sees “signs that demand is not where [OEMs] need it to be”.

And there remains the perennial UK concern about the ongoing lack of incentives to push private buyers towards EVs. In November, 77.4pc of the 24,359 new BEVs reaching the road in the month were fleet or business customers.

Insider Focus LTD (Company #14789403)