Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

Europe’s third largest fully electric market still growing as Germany and Norway join the UK in November year-on-year slides

Four of Europe’s five largest national markets for new BEV sales have now released November data. And only France has recorded year-on-year growth in 2023’s 11th month, as Germany and Norway join the UK in posting declines.

France’s November BEV sales were just over 34,500, according to the French arm of lobby group the European Association for Electromobility, or Avere, up by 53.3pc year-on-year. That monthly figure is higher than any of the data for French sales in previous 2023 months recorded by continent-wide lobby group the European Automobile Manufacturers’ Association, or Acea, which reports later in the month.

But Avere figures are consistently higher than Acea’s, suggesting the French group records sales, possibly of non-passenger BEVs, that Acea does not include. Nonetheless, the two datasets show enough correlation and the year-on-year increase is sufficiently high that we can be confident, once Acea data become available, that France will be posting a healthy year-on-year increase in that dataset too.

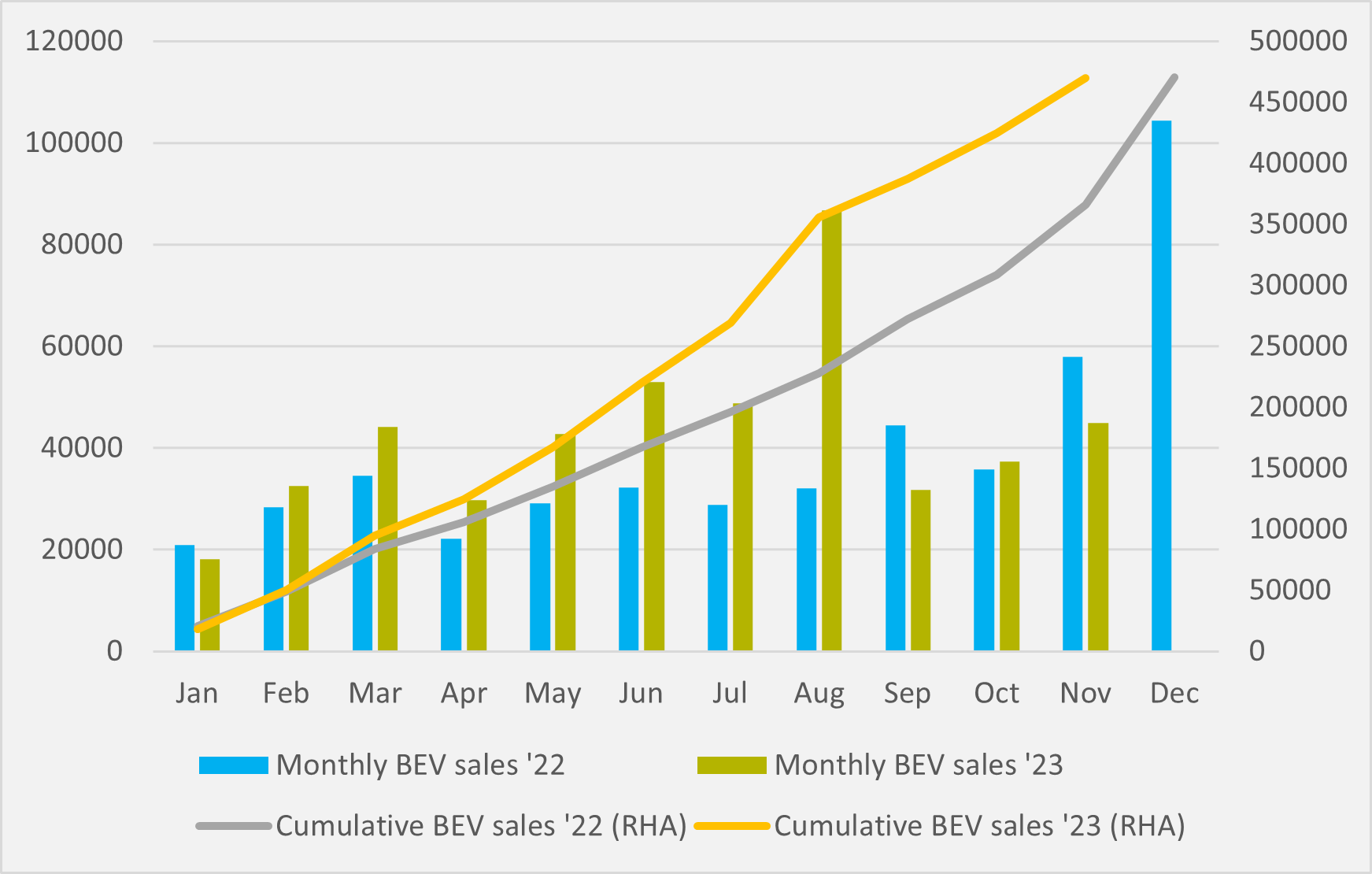

France’s cumulative year-on-year growth, with the caveat that this is provisionally using Avere November data built onto Acea Jan-Oct figures, now stands at more than 80,000 additional new BVs sold, or an almost 47pc rise compared to Jan-Nov ’22 (see main image).

Doom and gloom

And that positive picture will be important to offset the gloominess of German and Norwegian data showing year-on-year declines in new BEV sales in November, joining the UK in doing so. Germany’s is Europe’s largest national BEV market, with the UK second, France third and Norway fifth. Fourth placed Netherlands has yet to provide broken-out BEVs sales for November.

Germany and Norway are unlike the UK in that November is not their first rodeo for year-on-year monthly declines in 2023, with both markets serving as poster boys for what tinkering with subsidies can do to new BEV sales momentum. The two countries actually kicked off the year posting lower sales in January compared to the first month of 2022, and in both cases it was off the back of subsidy regimes being changes at end-of-year.

Germany had a second intra-year change in its incentives offering at the end of August, which saw a spike in sales ahead of its expiry and a slump after it (see Fig.1). That all results in November being its third month of the year, after January and September, that has seen 2023 new BEV sales below the same month in 2022.

On a more positive note, November represented another month of recovery from that September post-subsidy cratering. Sales just shy of 45,000 is a higher number than any of the first ten months of 2002, or the first four months of 2023 either.

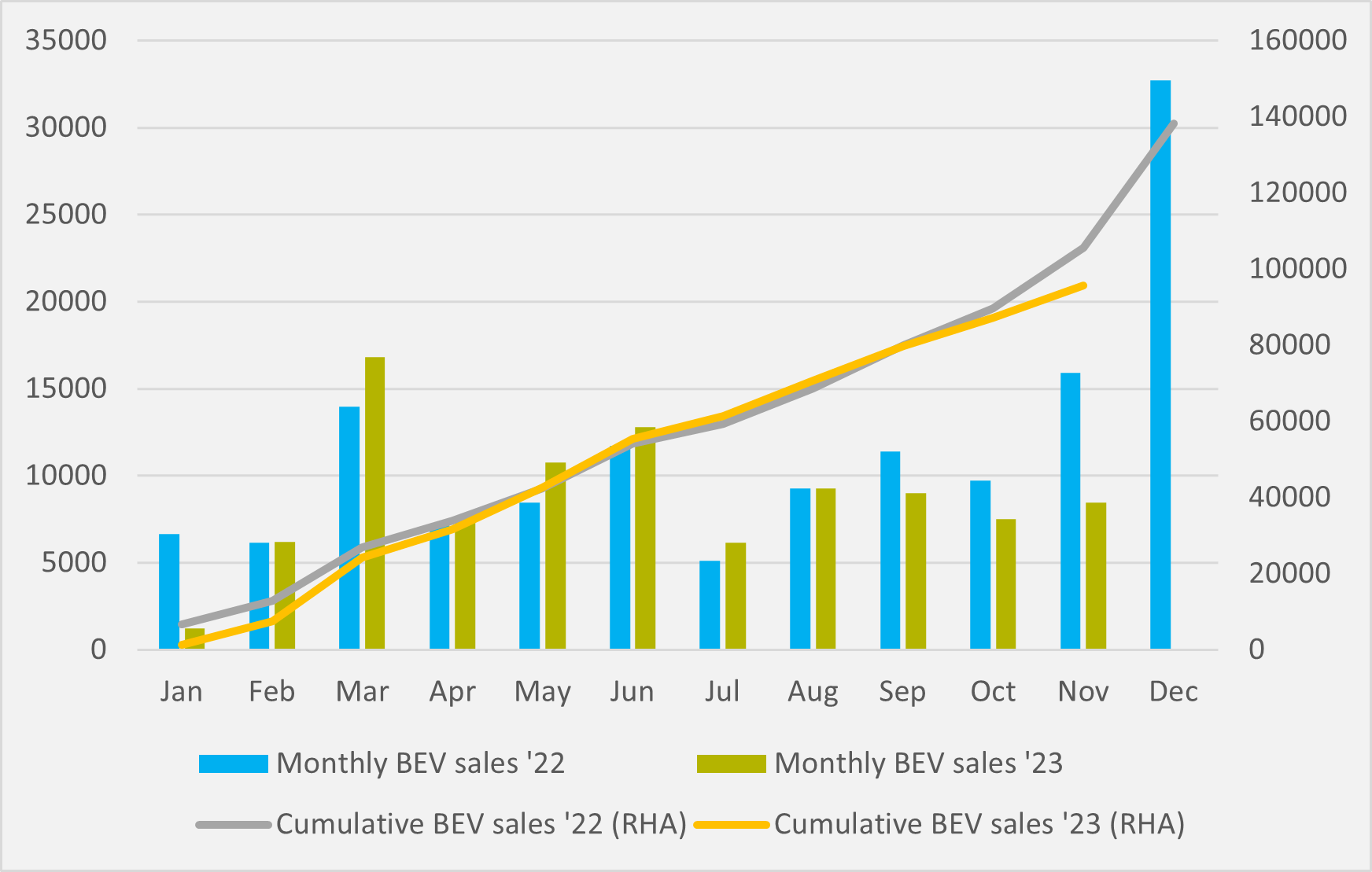

Norway has fewer silver linings, as, unlike Germany’s cumulative picture — where 2003 year-to-date sales remain 100,000+ more than in the first eleven months of 2022 — the country has actually sold fever new BEVs this year than in the same period last (see Fig.2). Sales have struggled to recover from their sluggish start, with even seven months from February to August of relatively muted year-on-growth only just managing to overhaul the January deficit.

But three straight months of selling less than last year have put Norway firmly back into annual deficit. This may, though, be largely a factor of different stages of market maturity. When a relatively small overall market like Norway reaches close to 90pc penetration for BEVs — and particularly given an additional focus specific to Norway at trying to reduce private car ownership and usage — the scope for maintaining strong year-on-year growth is much more limited than in countries where ICE sales remain dominant.

Insider Focus LTD (Company #14789403)