Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

ICE car sales grew at a rate greater than that of the overall LDV market in February

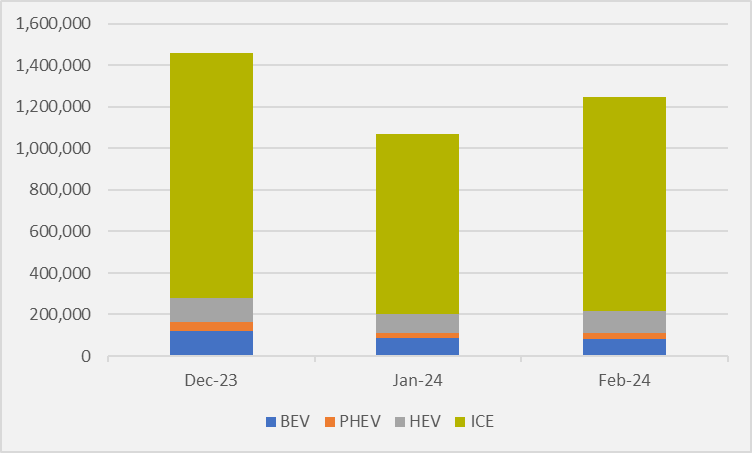

US BEV sales saw less than 1pc year-on-year growth in February, according to new data from the Department of Energy's Argonne National Laboratory.

81,946 new BEVs were sold in the US in February, only a 0.97pc increase from the same period last year, supporting estimates espoused by several OEMs and consultancies that US BEV demand growth would slow in 2024.

The market also saw a month-on-month decline of 3pc between January and February, compared to a month-on-month rise between January 2023 and February 2023.

The 3pc month-on-month decline in 2024 came even as the overall US LDV market grew by 16.5pc.

Lukewarm demand outlooks have defined the start to 2024 for many US OEMs, including legacy automaker GM, which has not committed to EV targets or financial guidance after shelving its EV strategy in late 2023.

Market leader Tesla is also expected by Wells Fargo automotive analyst Colin Langan to post flat sales volumes by year-end 2024.

Detroit OEM Ford, though, posted its best year-on-year growth in EV sales since April 2023 as it reported 6,367 February BEV sales, 80.8pc up compared to the same period in 2023 (albeit the Detroit heavyweight was hit by issues with both its F-150 Lightning and Mustang Mach-E in Q1 last year).

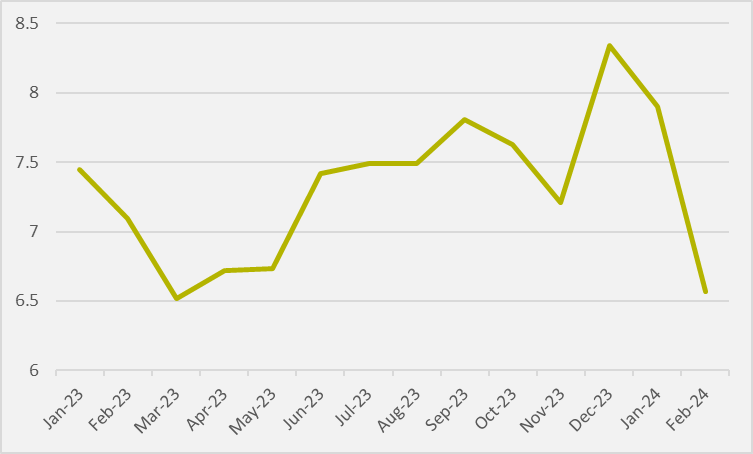

BEV market share has fallen to an eleven-month low at 6.57pc of new LDV sales in February, the Argonne figures also show.

Plug-in vehicles, however, saw strong growth of 11.4pc year-on-year, driven almost entirely by plug-in hybrids, which saw a 58.9pc rise for the same period.

But this growth did not come at the expense of ICE sales, which rose 18.9pc year-on-year, materially higher than the growth rate of the overall LDV market.

Insider Focus LTD (Company #14789403)