Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

That electrification innovation born in China does not stay in China is a lesson everyone should learn

Who is aiming to be ‘the Tesla of hybrids’? The answer is no-one, which EV inFocus has always taken as a very good basis for concluding that the auto industry does not seriously believe that hybrids have any meaningful role to play in the long-term journey to electrified road transport, and rather are a solution to short-term range and charging hurdles for BEVs.

But what if there are companies aiming to be ‘the Tesla’ of a very specific type of electric/liquid fuel solution? We are talking here about extended range EVs (EREVs), which might be one of the most important current trends in the Chinese EV market of which you have only vaguely heard.

EREVs are a type of light hybrid where an ICE — in the case of most Chinese EREVS a 1.5l petrol engine — does not power the vehicle itself at any point but can be used to replenish the battery. Hence the extended range, in most cases taking a 150-300km battery-only range up to 1100-14000km, admittedly using the notoriously optimistic Chinese CLTC measurements.

Supercharging growth

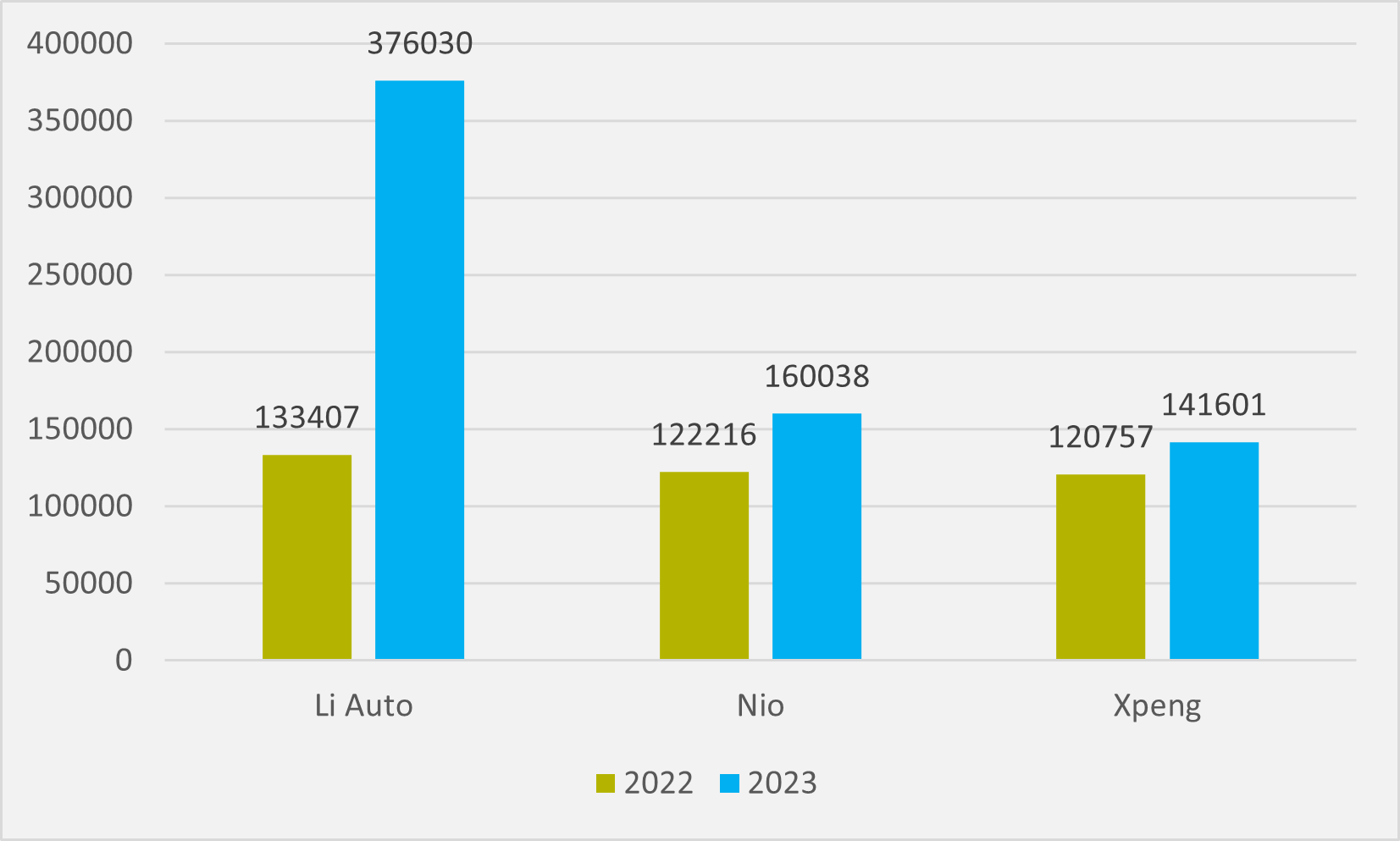

And firms that are good at EREV are doing very well in China. Most notably, Li Auto, which currently only sells this type of vehicle, has seen its sales rise by more than 180pc year-on-year in 2023, far outstripping more modest increase from peers Nio and Xpeng (see Fig.1).

All three firms sold roughly similar numbers of cars in 2022. But, in 2023, the EREV maker left the two firms that manufacture only BEVs in the dust.

It is worth noting that Li does not want to put all of its eggs in the EREV basket. It will launch its Li Mega MPV as a first BEV offering in March, with a further three BEVs following in H2’24 and two more in 2025.

But it will also launch its L6 EREV this year, targeting a more affordable RMB250,000-300,000 ($35-42,000) segment than its current L7, 8 and 9 EREV SUVs. It had additional plans for a smaller non-SUV too.

Nor is Li alone both in pursuing this parallel approach of BEV+EREV, or of making a success of it. China’s Leapmotor launched an EREV version of its C11 BEV in March, following its up with super range extender versions of the C01 and C11 in September.

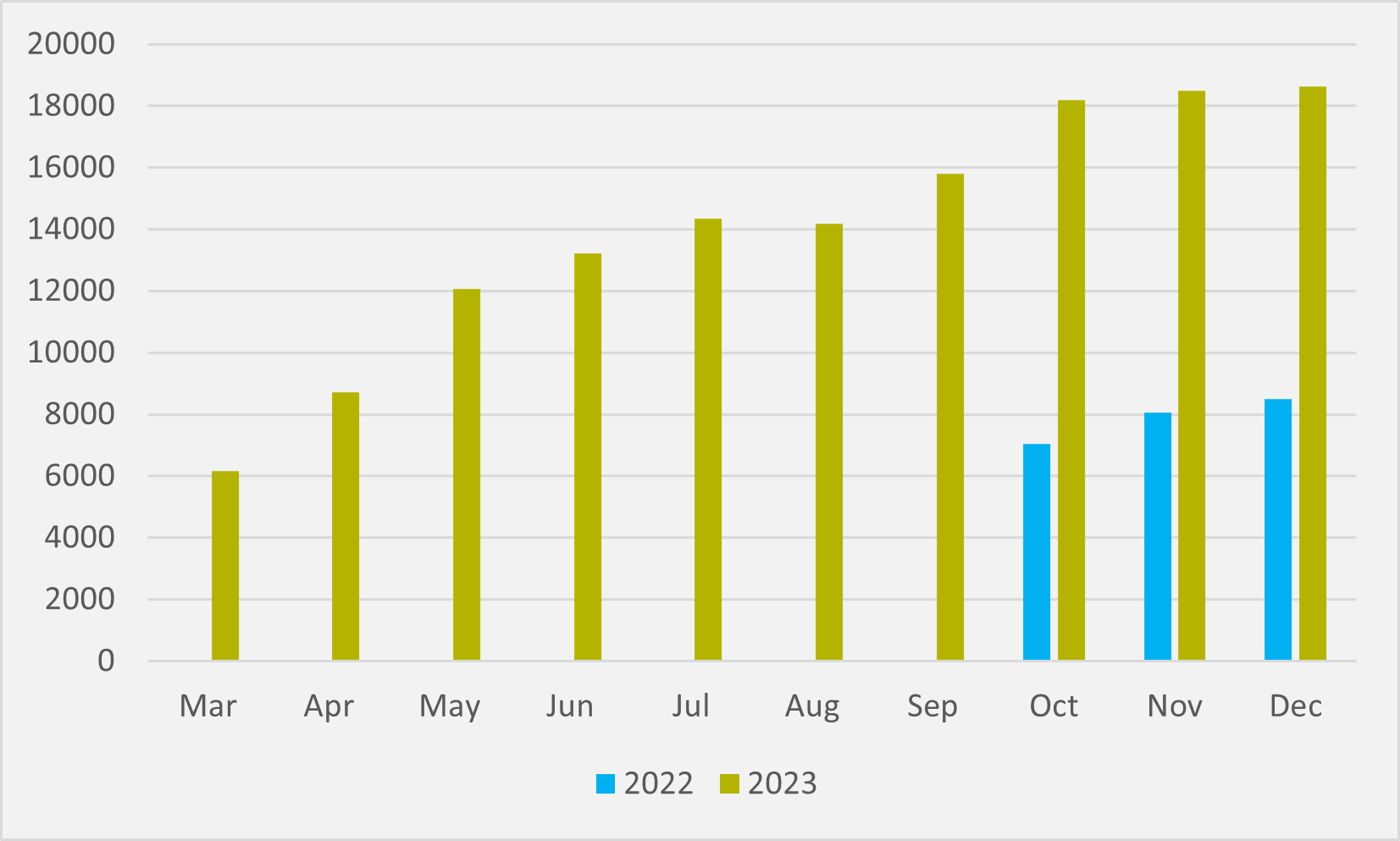

Its sales have been a tear ever since, something Leapmotor management attributes firmly to its new approach of offering EREV options alongside BEV. The firm’s sales in each of the Q4 months have topped 18,000 and more than doubled compared to the same months in 2022 (see Fig.2).

Leapmotor boasts that it has now sold more than 300,000 cars in total. But it has shifted the third 100,000 of those in less than six months as its EREV strategy kicked in, compared to a year for its second 100,000 and three years for the first.

Increasing options

And this is not escaping the notice of other Chinese manufacturers. There have been a lot of column inches about China’s BYD selling more BEVs than US BEV pure play Tesla in Q4’23. Less has been said that BYD also shifted more than 400,000 PHEVs in the quarter.

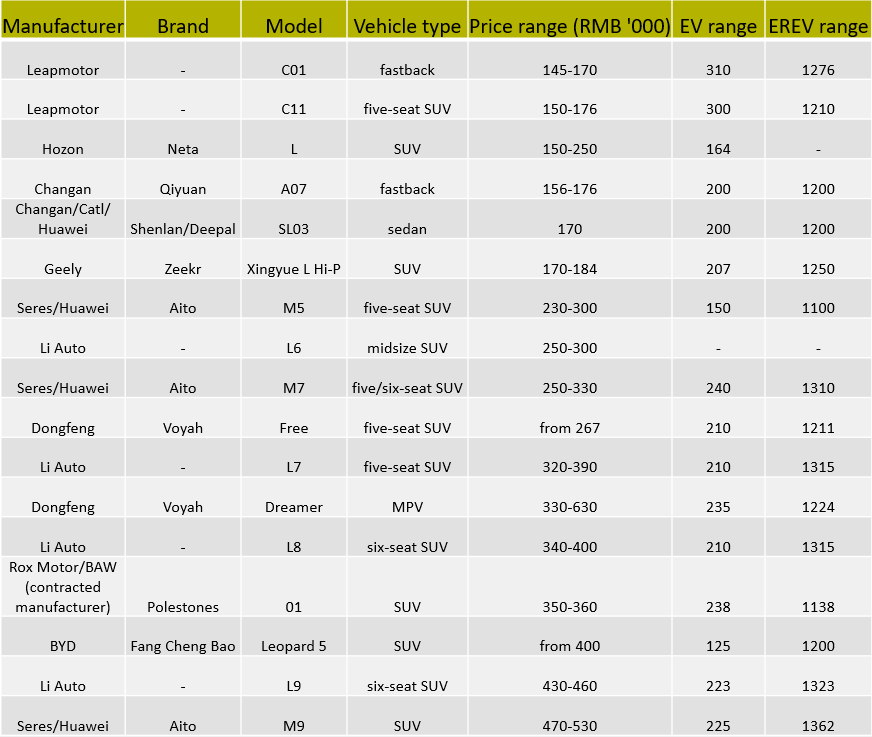

But the firm also has a brand called Fang Cheng Bao that is, as EV inFocus understands it, working on an EREV version of its Leopard 5 model. Indeed, our research has uncovered 17 EREVs either available or under development in China (see Fig.3).

As well as Li Auto, Leapmotor and BYD, the list includes several other prominent Chinese car manufacturers such as Geely, Dongfeng, Changan and Seres. It also encompasses firms such as software heavyweight Huawei and battery leader Catl.

Reflecting China’s more fluid auto industry, the list also includes the Polestones 01 from Rox Motors. The firm was set up by a vacuum cleaner tycoon — and simply outsourced design of the EREV to Italy’s Pininfarina and its manufacture to China’s BAW.

The slew of existing and planned EREVs serves a wide range of different price brackets, from RMB150,000-200,000 to large SUVs over RMB400,000. And other models from big hitters could be one the way — with reports that Chinese mobile phone heavyweight Xiaomi is likely to go EREV with one of its entries into the EV space.

Some suggestions are that this will be with a planned third model, or in a second phase of development. But other stories coming out of China suggest the firm is already recruiting for EREV experience and could offer an EREV option on its first SU7 launch in relatively short order.

Avatr Technology, which can boast backing from Catl, Huawei and Changan, has also been linked with developing an EREV.

Going global

An interesting article from CarNewsChina.com highlights a planned EREV version of the Exeed Exlantix ET from Chinese OEM Chery. Its headline is that the model could be a “Li Auto L7 for the overseas markets”.

This is a reference to EREV leader Li’s reluctance to look at export markets until 2028, potentially leaving a gap for other Chinese OEMs to exploit international appetite for a technology that could offer an attractive solution to range anxiety putting buyers off opting for BEVs.

But not every Chinese EREV maker is going to wait until late in the decade to try to go global. Leapmotor, for one, is explicit about its international ambitions — including its October tie-up with Franco-Italian conglomerate Stellantis that it is clearly hungry to use as a stepping stone to increase its ex-China footprint.

Its first model explicitly for international markets is the C10 BEV. But it seems more than feasible that it has plans to export EREV options beyond China too.

And that should be wake-up call for Western OEMs that — as well as considering what to do about a potential ‘Chinese invasion’ in the BEV space — they should also consider whether EREVs could open a new front. Even more dangerously, EREVs could pose a far sooner and more serious challenge to their HEV and PHEV footholds than they might have been anticipating BEVs would.

There are signs that automakers are beginning to grasp the EREV nettle. For example, Japan's Mazda already has an EREV, the MX-30 R-EV, in its line-up — explicitly noting that it is "a plug-in hybrid like no other".

And Stellantis’ US Jeep brand is trailing an EREV version of its Ram 1500 e-pickup, albeit probably not until 2025 at the earliest.

Ironically, Western OEMs have had previous experience with EREVs, but have since largely stepped away from the technology. GM’s Chevrolet Volt was an EREV, as was the US legacy manufacturer’s Cadillac ELR built on the same drivetrain. And Germany’s BMW offered an EREV version of its i3 called REX.

Whether the industry’s established names live to regret turning away from EREV — or never giving it serious consideration in the first place — remains to be seen. But the peril of simply ignoring electrification trends that emerge in China is already proven.

Insider Focus LTD (Company #14789403)