Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The largest national market remains on track for 1mn+ BEVs by year-end

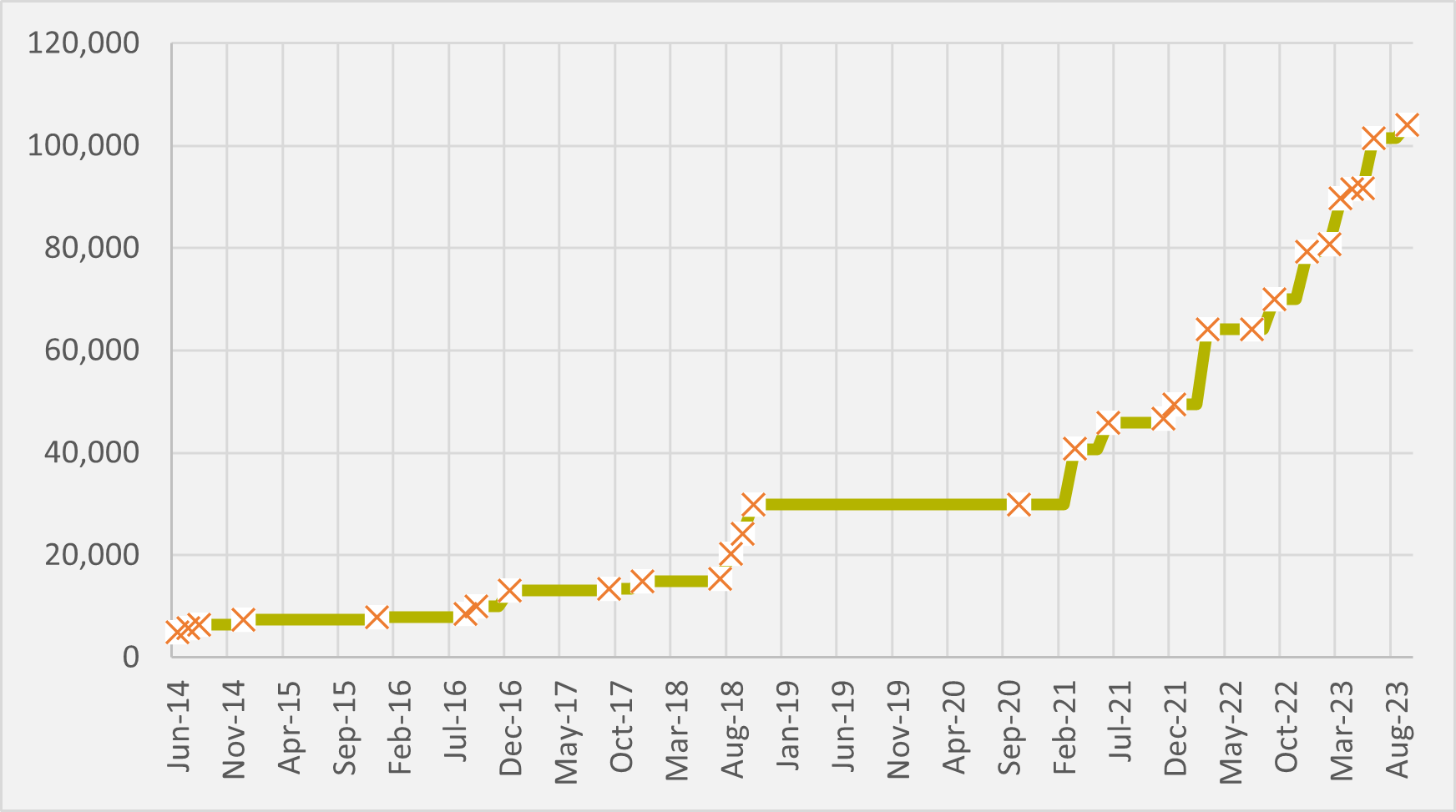

September saw the most BEVs ever sold in the US in a single month, with 104,015 new all-electric vehicles registered, according to data from the Department of Energy’s Argonne National Laboratory.

These numbers amount to a 4.73pc increase in BEV sales month-on-month and a 32.6pc increase over September 2022.

While in a broad context, US BEV sales are on a steady rise, the record broken in September reverses the dip seen in registrations since the last record month for sales in June. That month saw registrations eclipse 100,000 for the first time, and following a two-month drop-off, September sees sales scale the heights of six-figure numbers once again (see Fig.1).

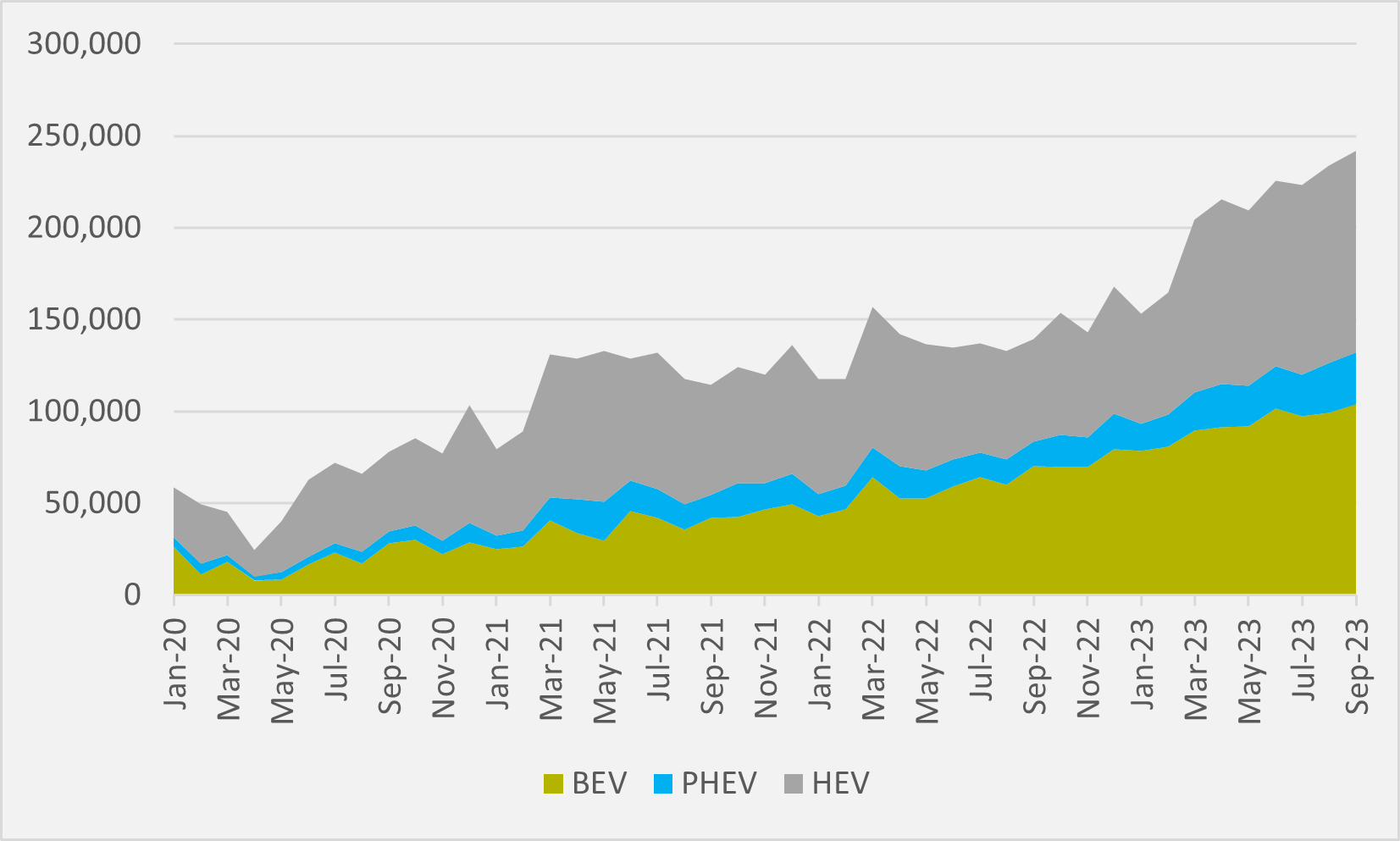

September also saw BEVs claim their largest ever market share of all LDV sales, rising to 7.8pc. And, for the first time, sales of EVs of all hues, including HEVs and PHEVs, topped 18pc of total US new light-duty vehicles (LDVs) in a month (see main image). Total EV new sales in September topped 240,000 (see Fig.2).

Compared to September last year, US drivers bought almost 208,000 more LDVs in the ninth month of this year. EVs of all hues boosted their sales by 102,000 year-on-year, meaning they represent some 49pc of all growth. Twelve months ago, only two of every 16 vehicles sold was an EV. Last month, that ratio was two in 11.

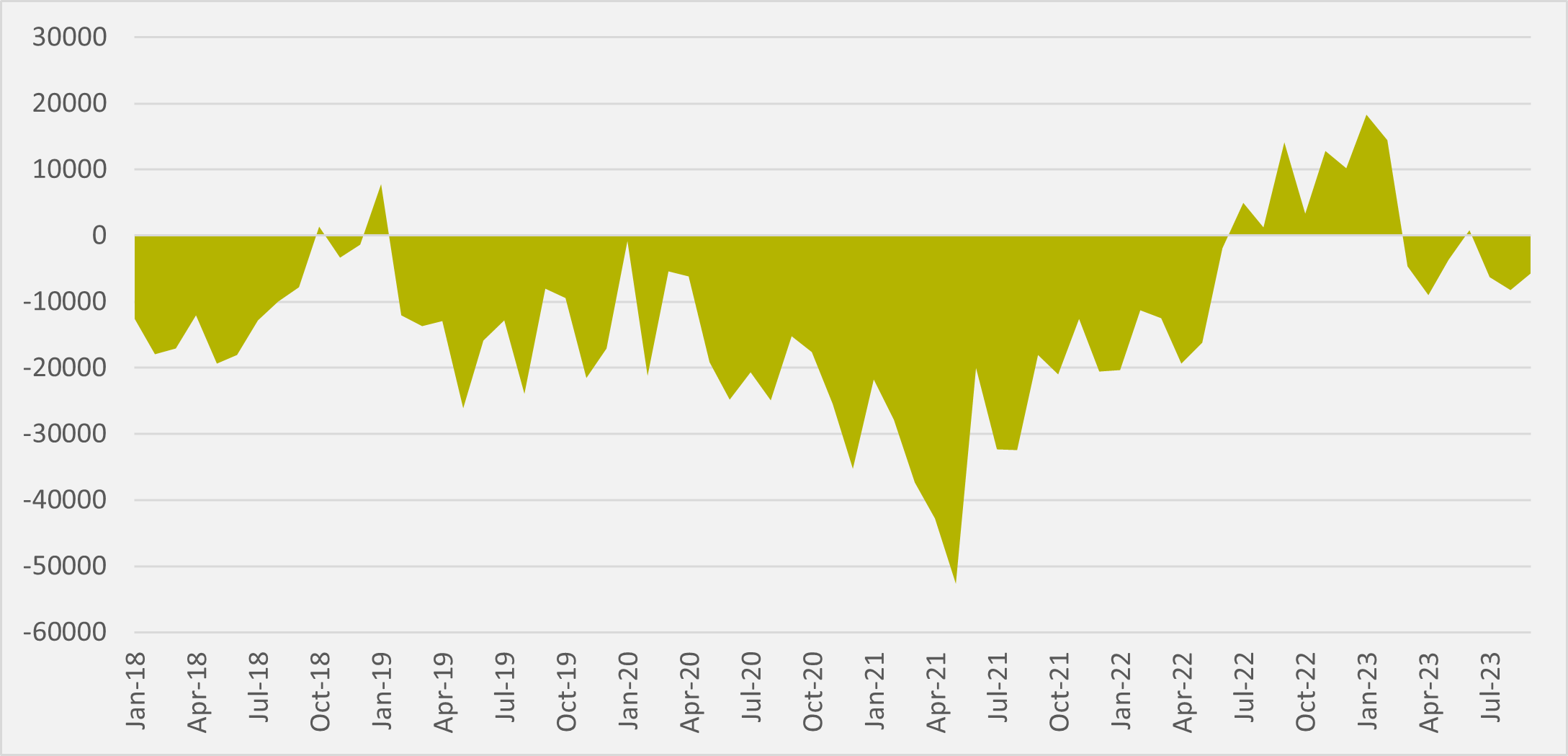

HEVs continue to marginally outperform BEVs in sales, with 109,374 vehicles registered in September. A resurgence of BEV sales outstripping those of HEVs in the second half of 2022 has proven short-lived (see Fig.3).

Japanese legacy manufacturer Toyota was responsible for 46.1pc of all HEV sales across the month, according to Argonne. Long a stalwart in the hybrid market, September saw Toyota make several high-profile announcements indicating greater commitment to BEVs — including partnering with South Korea’s LG Energy Solutions for a US battery plant, and a joint venture with Japanese energy company Idemitsu Kosan to produce solid state batteries.

Stiffer competition

According to data from consultancy Motor Intelligence, BEV market leader Tesla sold 51,451 BEVs in September. This, integrated with the Argonne data, puts Tesla’s US market share at 49.5pc for the month. Last week, data from consultancy Cox Automotive put the Elon Musk-led firm’s share of September sales at a fraction above 50pc.

Both figures tell a story of greater competition in the US BEV segment, thanks in part to legacy ICE market players converting more of their sales into BEVs. Amongst legacy OEMs, German firm BMW sold the highest proportion of EVs, with 15.6pc of its sales being electric, according to separate data from Cox Automotive.

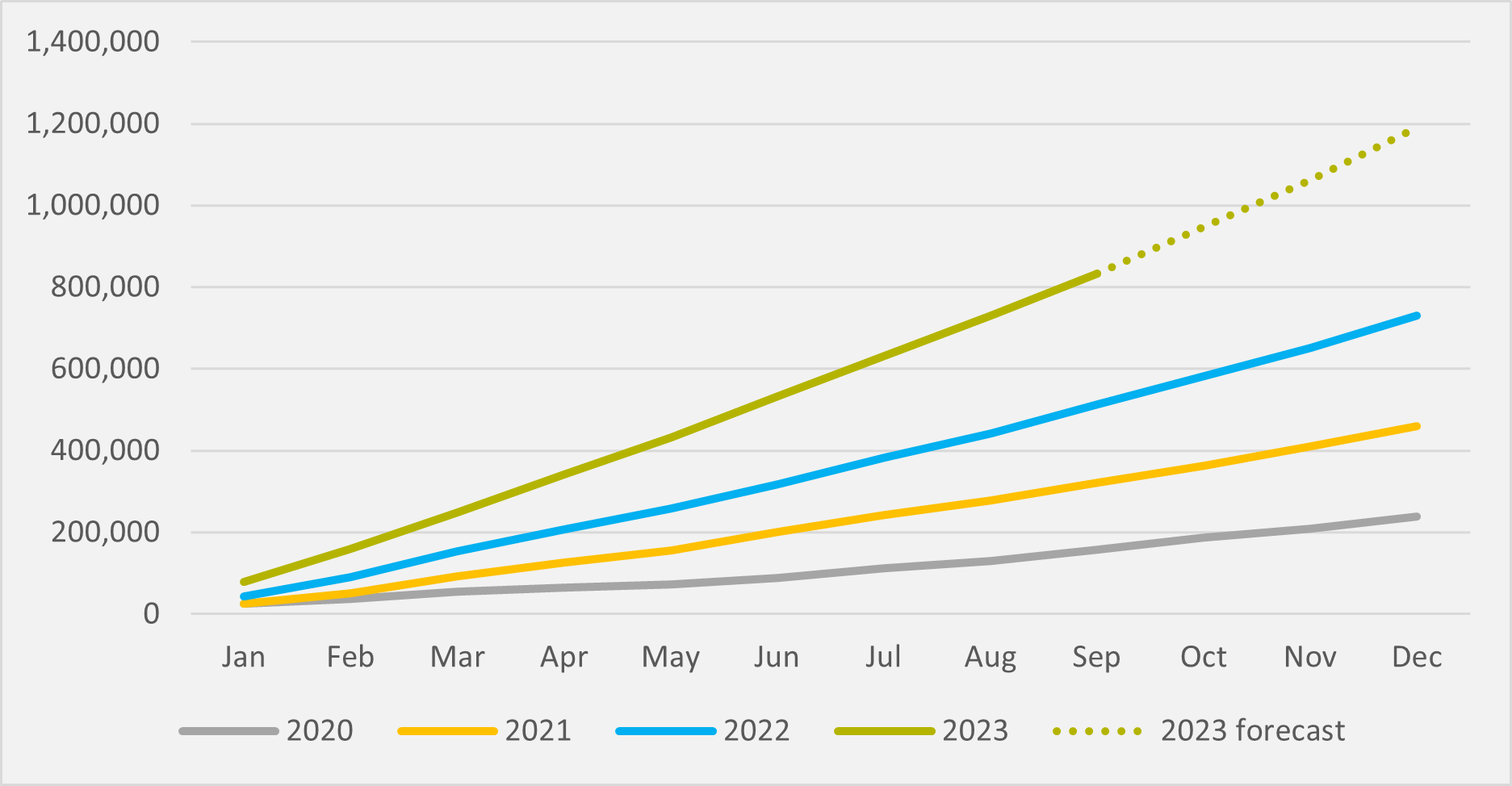

On track for seven figures

In May, EV inFocus forecasted that the US was on track to surpass 1mn BEV sales by the end of 2023. The latest Argonne data shows that the real sales have matched these forecasts very closely, albeit the year-on-year growth rates have been moderating slightly as 2023 has progressed.

Year-to-date BEV sales have now comfortably exceeded the level reached in 2022 as a whole, breaking through the 800,000 mark by the end of September. The latest EV inFocus forecast suggests new BEV sales for 2023 topping out at just shy of 1.2mn (see Fig.4).

Insider Focus LTD (Company #14789403)