Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Retaining momentum in the world’s most competitive BEV market is hard

Chinese EV pure play start-up Nio had a great second half of 2023. But its start to the new year and its ongoing profitability woes serve as a reminder that standing still is not an option in China’s BEV market.

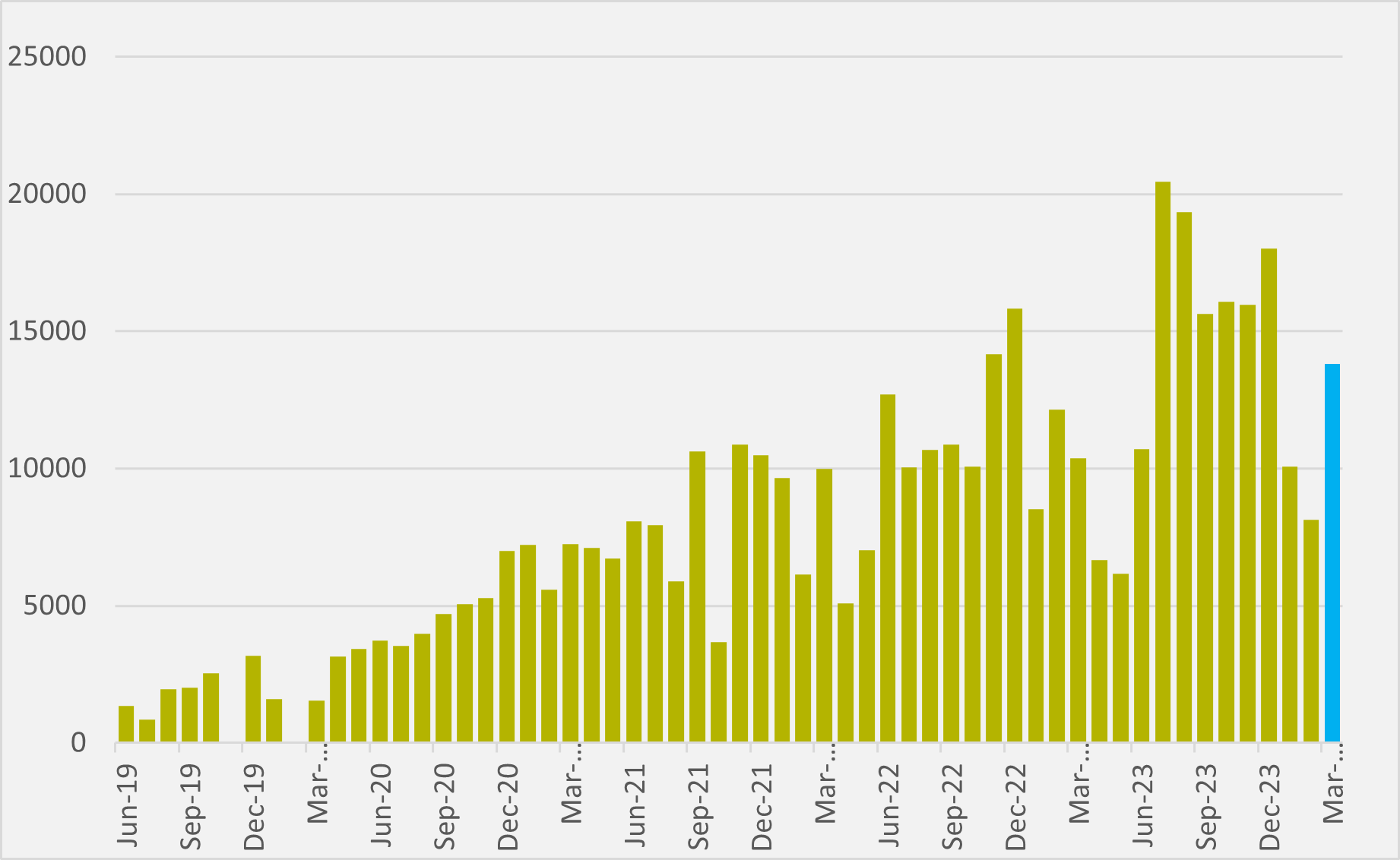

The firm sold more than 15,000 cars/month in each of the last six months of 2023, having previously topped that mark only once before, and even breached 20,000 vehicles sold in July. At the end of H1’23, the firm had shifted only 4,000 units more than in the same period in 2022.

But in the second half of the year, sales rose by almost 34,000 year-on-year as Nio racked up six-figures worth of sales across Jul-Dec. Its overall 2023 sales were up by 31pc, although it is worth noting its income from vehicles sales rose by only 8.2pc. Vehicle margin in 2023 was compacted to 9.5pc, compared with 13.7pc for the previous year.

Tough start to the year

And, even in its better H2 sales performance, Nio’s Q4 volumes dipped slightly from Q3. That trend has continued into Q1 (see Fig.1).

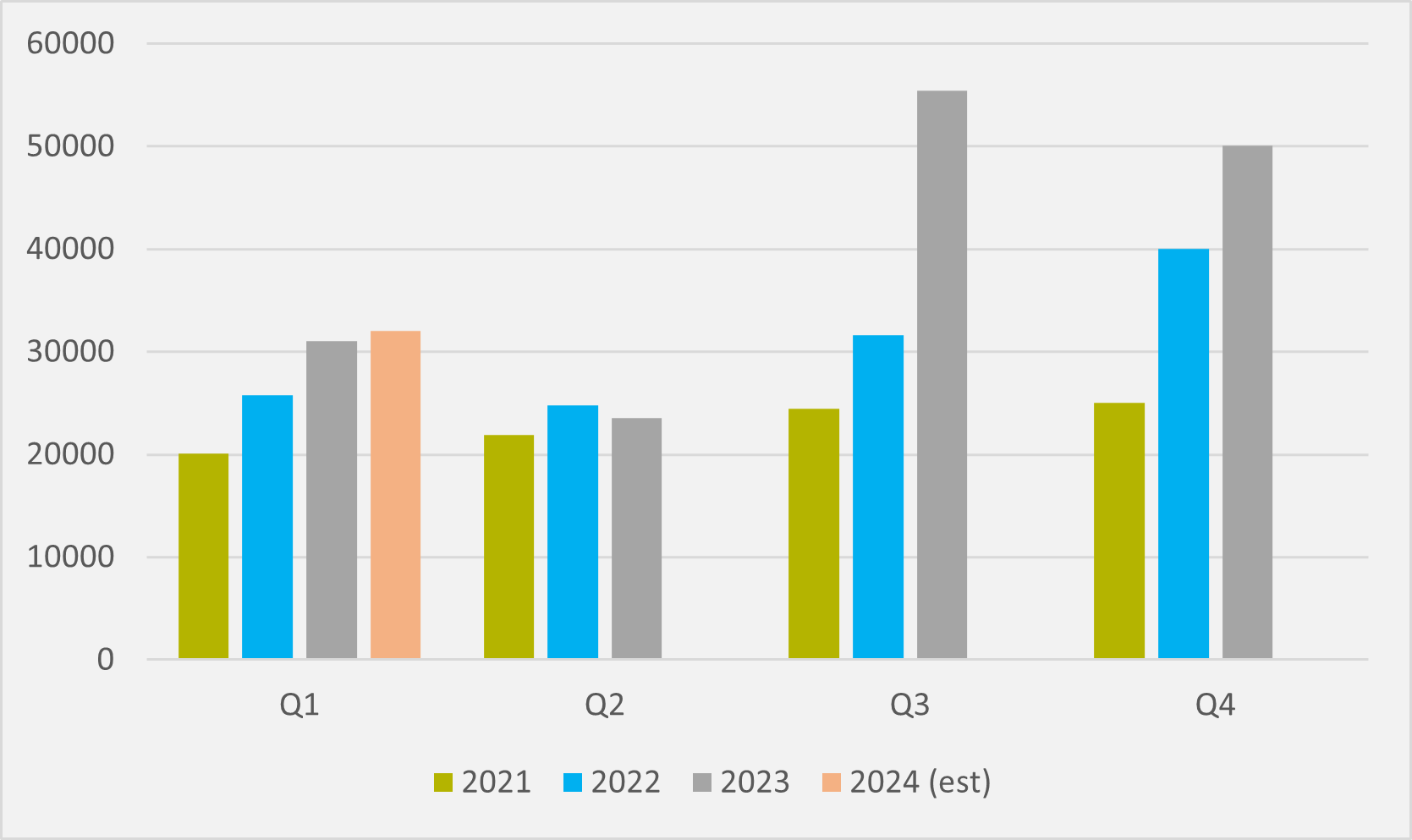

Nio volumes in January and February have slipped back to around and even under 10,000/month. While it is forecasting March deliveries to rebound somewhat, its expectations for Q1 as a whole are only roughly on a par with Q1’23 (see Fig.2).

Guided Q1 deliveries are “below consensus”, says Bo Pei, an analyst at New York-based brokerage US Tiger Securities, who has cut his Nio price target from $12/share to $8/share. “The company guided Q1 deliveries to 31,000-33,000, or a 36pc sequential decline at the midpoint, on unfavourable seasonality and competition,” Pei continues.

US Tiger Securities had been expecting the firm to deliver over 220,000 vehicles in 2024, which would have represented another almost 39pc year-on-year rise in volumes. But it has now revised its forecasts down to just under 180,000, or an annual increase of c.12.5pc (see main image).

And this means an estimated revenue from auto sales this year of RMB54.8bn — as the brokerage has also reduced its expected average sales price down from RMB329,000 to RMB304,000 — compared to previous expectations that Nio could bring in RMB72.9bn from vehicle sales this year.

Margins are also under pressure, although could improve later in the year.

“Management mentioned vehicle gross margin will likely decrease quarter-on-quarter in Q1 as the company transitions to 2024 models and offers promotions for the old models,” the analyst cautions. “But Nio expects vehicle margin to recover in Q2, and still targets to achieve 15-18pc later this year.”

“Nio “will start delivering the 2024 models this month, which should help improve average price and vehicle margin”, he predicts. Margin was actually one of the brighter parts of Nio Q4 story, at 11.9pc, up by 0.89 percentage points quarter-on-quarter, owing to decreased material cost per unit, Pei notes.

But Q4’s average net unit price of RMB308,000 ($42,800) was down by 16pc year-on-year and by 2pc quarter-on-quarter on “product mix shift”, emphasising how cut-throat Chinese BEV competition is. And Nio is expecting to bring in 1.7-3.8pc less revenue in Q1 year-on-year despite selling a roughly similar volume of cars, suggesting no let-up in competitive pressures.

The firm continues to be loss-making, with the situation worsening in 2023. Even though its total revenues rose by 12.9pc to RMB55.6bn, its gross profit fell by 40.7pc year-on-year, gross margins came down from 10.4pc to 5.5pc, its operating losses jumped by 44.8pc to RMB22.7bn and its net loss by 43.5pc to RMB20.7bn.

New brand

The firm is pining some of its hopes on eventually reaching breakeven on its new the mass market Alps brand, which, according to Pei, it will unveil in Q2, release its first model in Q3, and start deliveries in Q4. “Alps will focus on the family market and the first model is directly competing with [the Tesla] Model Y, but [Nio] claims the manufacturing cost will be 10pc lower at reasonable volume,” the analyst says. Alps’ second model will be a large family SUV.

“Compared with Nio, Alps will focus more on volume rather than gross margin,” Pei continues. “The new brand will share most of Nio’s charging and battery swapping network. The company targets 200 stores for the new brand this year.”

Insider Focus LTD (Company #14789403)