Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

The fast charging-focused CPO is set to further geographically diversify its site footprint

The ambitions of Dutch charge point operator (CPO) Fastned to become a pan-European player will crystallise as it builds out its pipeline of secured sites. And two tender wins in Germany will accelerate progress on its 'Baltic Sea to the Mediterranean' strategy.

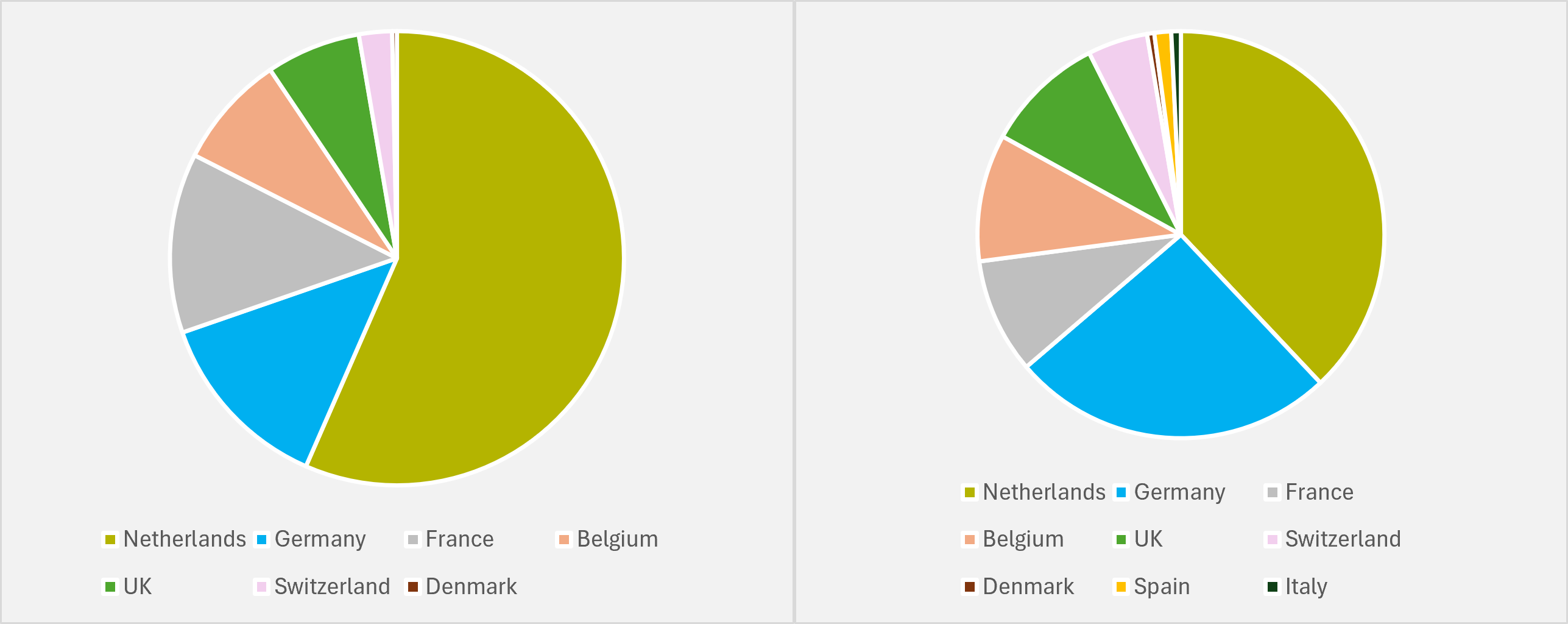

At the start of 2023, the firm had 242 charging stations across six European countries. But 61.6pc of these locations were in its home Dutch market, with Germany (15.3pc) the only other country with a double digit share of Fastned’s footprint.

Over the course of the last year, Fastned was able to add 55 new stations, a 22.3pc expansion in locations. And while the Netherlands was the country with the most new sites added with 19, that meant 36 new non-Dutch locations were completed, including a first in Denmark. This reduced the share of Dutch sites in the Fastned portfolio down to 56.6pc by the end of December.

Fastned’s locations under development, where it has acquired the rights to situate chargers but not yet brought the station into operation — including an additional 59 in 2023 alone — points to a continuation of the trend (see main image). The firm counts 135 such sites, of which only 31 are in the Netherlands. Bringing them all into operation would skew the Dutch to non-Dutch ratio even further to 46:54.

But these figures do not include an additional 92 German sites that Fastned has secured in two tranches of the Deutschlandnetz tender process, as it is still in the process of signing specific location agreements. Adding these into the pipeline means that Fastned’s geographic mix changes even further (see Fig.1): to just 38pc Dutch, 26pc German, c.10pc shares for each of France, the UK and Belgium, 5pc Swiss and smaller footprints in Denmark, Italy and Spain.

Becoming a pan-European CPO is important, given that a recent EV inFocus white paper concluded that the European charging landscape is ripe for consolidation and one of the drivers is too many smaller, single country-focused players. Fastned’s focus on highway fast charging, where drivers travelling significant distance will need to utilise public charging, should also offer it an advantage in any M&A flurry.

The firm also managed to raise €52mn in two separate bond issues last year, suggesting that issues around accessing capital that could also see peers become acquisition targets are not currently a Fastned concern. CEO Michiel Langezaal also hails his firm reporting positive Ebitda for 2023 as a whole, ticking the box on progress towards profitability that has also been raised as a question mark around some CPOs' survival.

Words to the wise

Langezaal also proffers advice to Europe’s legislators as they grapple with issues around incentivising EV adoption while not unduly penalising those drivers, especially the less well-off, that have previously chosen ICE vehicles. “Introducing a progressive road tax that supports investments in electric vehicles is something I favour,” Langezaal says.

“Let us continue a zero tariff for electric vehicles while at the same time introducing a significantly higher tariff for fossil-fuel cars that are less than three years old — while maintaining the base tariff for all other cars,” he continues. “This makes choosing a [new] fossil-fuel car while you have the option to go electric an expensive decision.”

He also suggests a focus on fleets could be productive. “Businesses are already more inclined to make the switch, given the ESG regulation requiring them to set emission reduction targets. A taxation regime whereby choosing an electric company car is incentivised for companies and employees, is the right thing to do,” Langezaal contends.

And he advocates that “taxation on fossil-fuel cars should be based on their emissions”. The headache of a hit to the public purse through a switch away from ICE vehicles to currently more lightly taxed EVs could be eased by “an annual increase of the zero-emission base tariff” which, Langezaal says, “should ensure stable government income”.

Insider Focus LTD (Company #14789403)