Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Volvo's EX30 has seen an impressive first four months of deliveries

Swedish OEM Volvo Cars' latest compact e-SUV, the EX30, has been hailed by the firm as the Europe's third best-selling BEV in March, after only its first quarter of major rollout. On the back of this success, Volvo management appears to setting ambitious targets for the vehicle.

Could it realistically snatch the continent's top spot away from the incumbent Tesla Model Y at a time when Elon Musk's firm is seeing its sales slow?

"The Q1 performance showed the early prospects of this car, even though deliveries are still on the ramp-up phase. The car is a profitable growth driver for us as a business, with deliveries in Q1 already reaching 14,500 cars and gross margins as planned between 15pc and 20pc," CEO Jim Rowan told analysts on the firm's Q1 results call.

This impressive progress raises the question of whether we might finally Tesla knocked off the top spot in Europe — and not by an upstart Chinese OEM, as many industry narratives have speculated, but by an established European automaker (albeit Volvo's largest shareholder is China's Geely and a material part of the EX30's competitive advantage is access to the Geely SEA platform).

Data collated by EV inFocus from six of Europe's biggest car markets puts into perspective how rapid the EX30's rise has been, and in comparison, how Tesla is seeing a year-on-year drop in sales.

"We really just started the EX30 sales; it came into full production in the back end of the first quarter, and we saw immediately the sales of that car be propelled to be the third bestselling EV in Europe, behind the Tesla Y and the Tesla 3," the CEO said on the Q1 call.

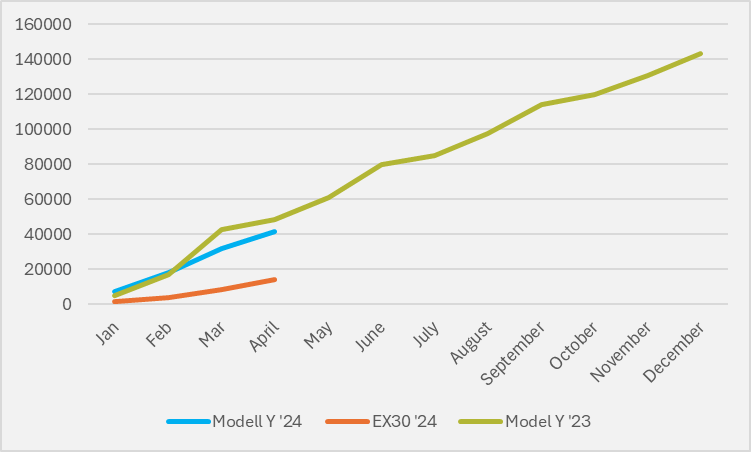

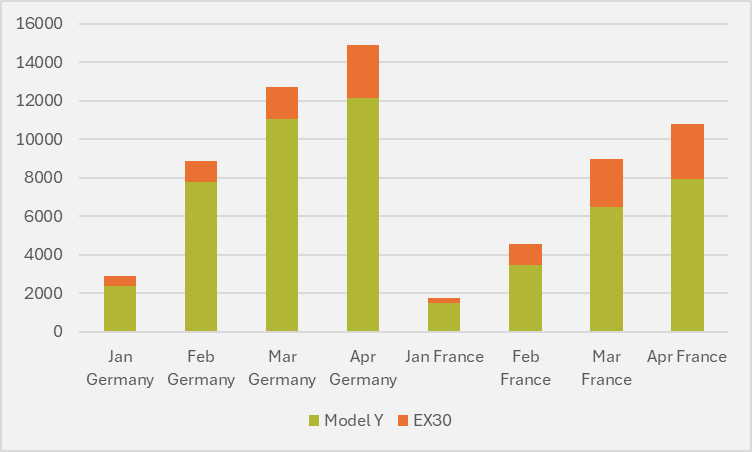

Looking at January-April sales data by model for Germany, France, the Netherlands, Norway Sweden and Spain — six of Europe's 10 largest national markets for BEVs sales — as a reasonable proxy for wider European sales, the EX30's progress does not yet match the Model Y, even though the latter is experiencing year-on-year growth headwinds (see Fig.1). But there is some context to justify Volvo's bullishness.

The EX30 only launched fully in Q1, having bagged around 100 deliveries in Germany in the final two months of 2023. To reach an almost 1:3 ratio with the Model Y, the world's best-selling EV which benefits from a long-established reputation, within four months of launch is no mean feat for Volvo.

In five of the six markets, the EX30 sold in around a 1:4 ratio to the Model Y. But the Volvo brand's Swedish heritage saw the EX30 sell nearly half as many units as the Model Y in the first four months of the year (2,042 compared to 4,423) in its home market. In contrast, the continent's biggest market, Germany, is proving the stiffest challenge to try to take all-electric market share from Tesla (see Fig.2).

Volvo has not committed to a volume target for the EX30 ramp, but CFO Johan Ekdahl says the new EV is "taking us to being well on track towards our guidance of at least 15pc volume growth in the full year 2024".

The EX30 has the advantage of being fresh. And it is also competing in the B segment, which is often seen as the core of the European market, even if customer appetite has ben shifting more towards C-segment vehicles in recent years.

In contrast, the Model Y dates back to a 2020 debut and is a D-segment vehicle. And while it has been Tesla's flagship vehicle for some time, there is no sign of a model refresh upcoming, even when the older Model 3 has recently received an upgrade.

So there are reasons to keep a close eye on EX30 over the coming months, to see if it can get even closer to Tesla's best seller.

Insider Focus LTD (Company #14789403)