Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

Delivery dip exceeds Tesla's warnings of no-growth 2024

US EV leader Tesla has seen an "unprecedented" dip in its Q1 deliveries, an analyst says, after Elon Musk's EV pure play posted its first year-on-year decline since 2020.

However, after falling behind Chinese rival BYD in deliveries in the final quarter of last year, Tesla now reclaims top position in global BEV sales after outselling BYD by almost 87,000 units.

"We have got a 40,000 unit miss relative to expectations, so I would put this in the category of a surprising, borderline unprecedented miss when it comes to deliveries," says Gene Munster, managing partner at investment firm Deepwater Asset Management.

The automaker delivered 386,810 units in the quarter, 8.5pc down from the previous year (see main image), and produced 433,371. While the company blamed production setbacks for declining volumes, Tesla's production fell considerably less than its deliveries, indicating that conversion rate is a larger problem than production.

Rising inventory

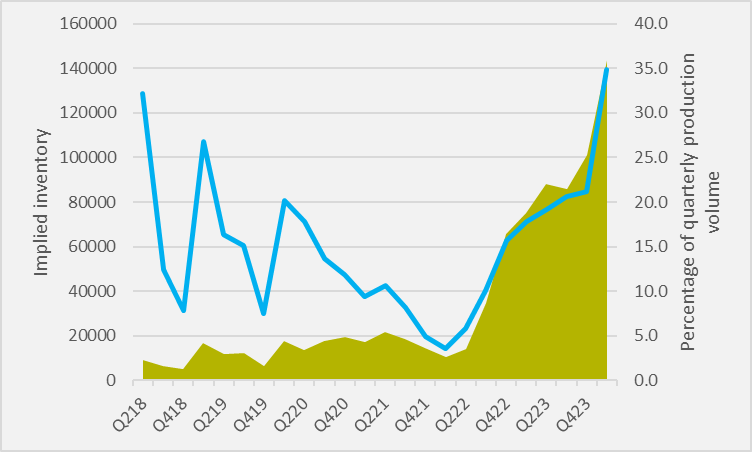

Barclays automotive analyst Dan Levy says that the gulf between Tesla's production and delivery numbers for the quarter "likely implies further price-downs ahead to clear this excess inventory" (see Fig.1).

"They likely built something like 45,000-50,000 units of inventory, which adds onto the 90,000-100,000 units they already had, so this extra inventory likely means there is going to be some negative pricing ahead," Levy believes.

And while Tesla's automotive margins have been shrinking for some time as continual price cuts have eaten into profitability, Levy says worse may be yet to come.

"You are going to have some weakness on margins coming, really testing the trough that we saw in the third quarter," Levy predicts.

Temporary lull

Both investors and Tesla management have, admittedly, been warning of little-to-no growth in 2024 for some time. And both Levy and Munster are confident that Tesla can regain an even footing.

"Others are struggling with EVs from a cost perspective; they cannot keep up with Tesla's pricing, so this reinforces what is going to be healthy market share for Tesla for EVs in the US" Levy says.

Munster adds that he "would be shocked" if Tesla management is rethinking its short-to medium term strategy. Tesla management "has a vision of where the world is going and they are playing towards that, and would say that this is a speedbump", he suggests.

And this reaction comes in part due to Tesla's woes being seen across the EV industry, reflected in the fact that despite its delivery dip, Tesla has once again become the world's leading BEV seller for the quarter.

"If you look at the numbers and look at the stock reaction, the stock should be down more, and I think the reason why it is not is because there are investors in the camp who think [it is] a painful bump, but ultimately it is a bump in the road," Munster says.

Insider Focus LTD (Company #14789403)