Stellantis spins more positive Fiat 500e story

The conglomerate tries to get beyond reports of idled production

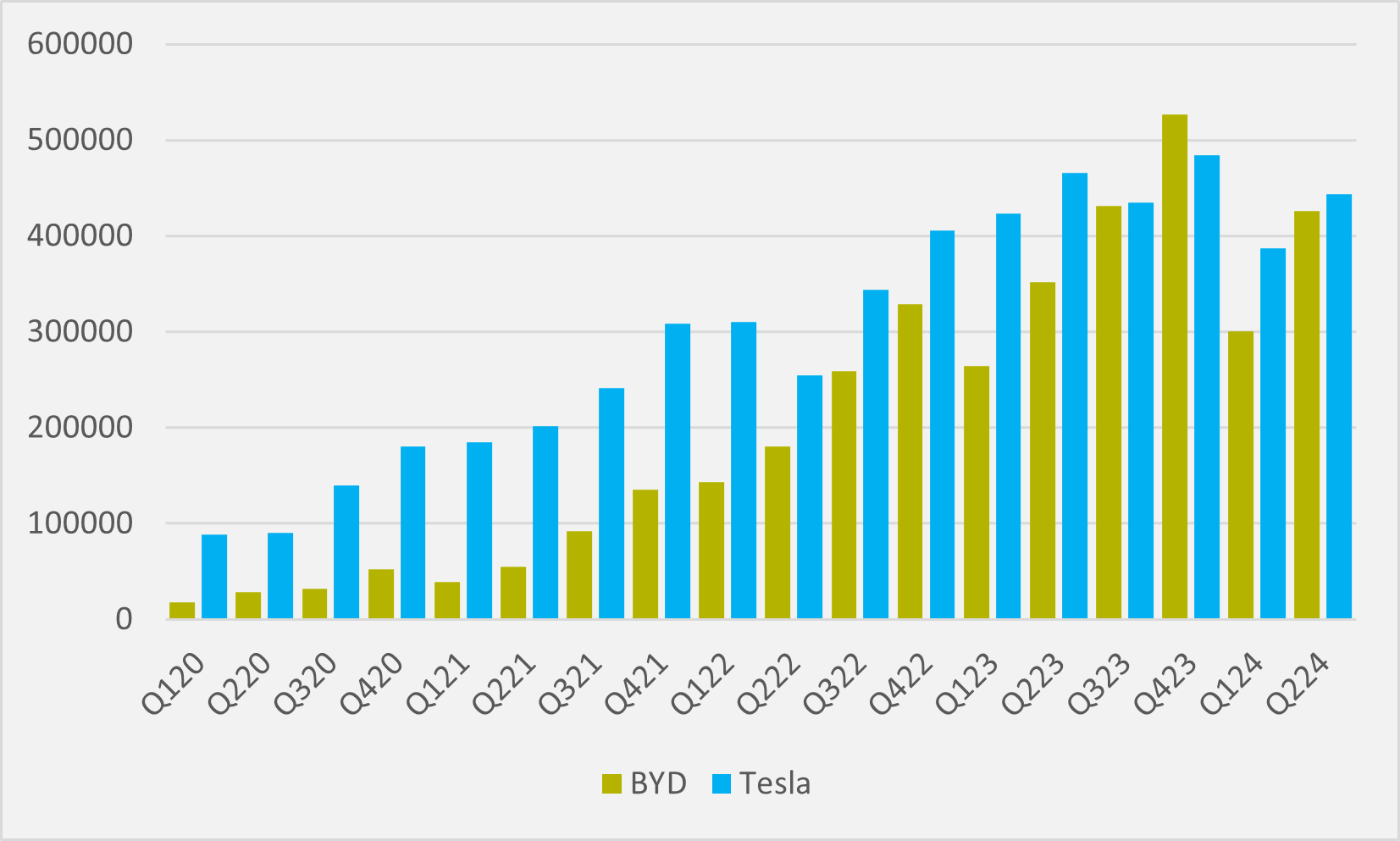

US EV pure play Tesla saw something of a rebound from disappointing Q1 sales as Q2 volumes beat analyst expectations and recorded the firm’s third highest quarterly deliveries. But, while not the 10.3pc year-on-year drop in sales seen in Q1, Q2 volumes were still down by 5.5pc from Q2’23.

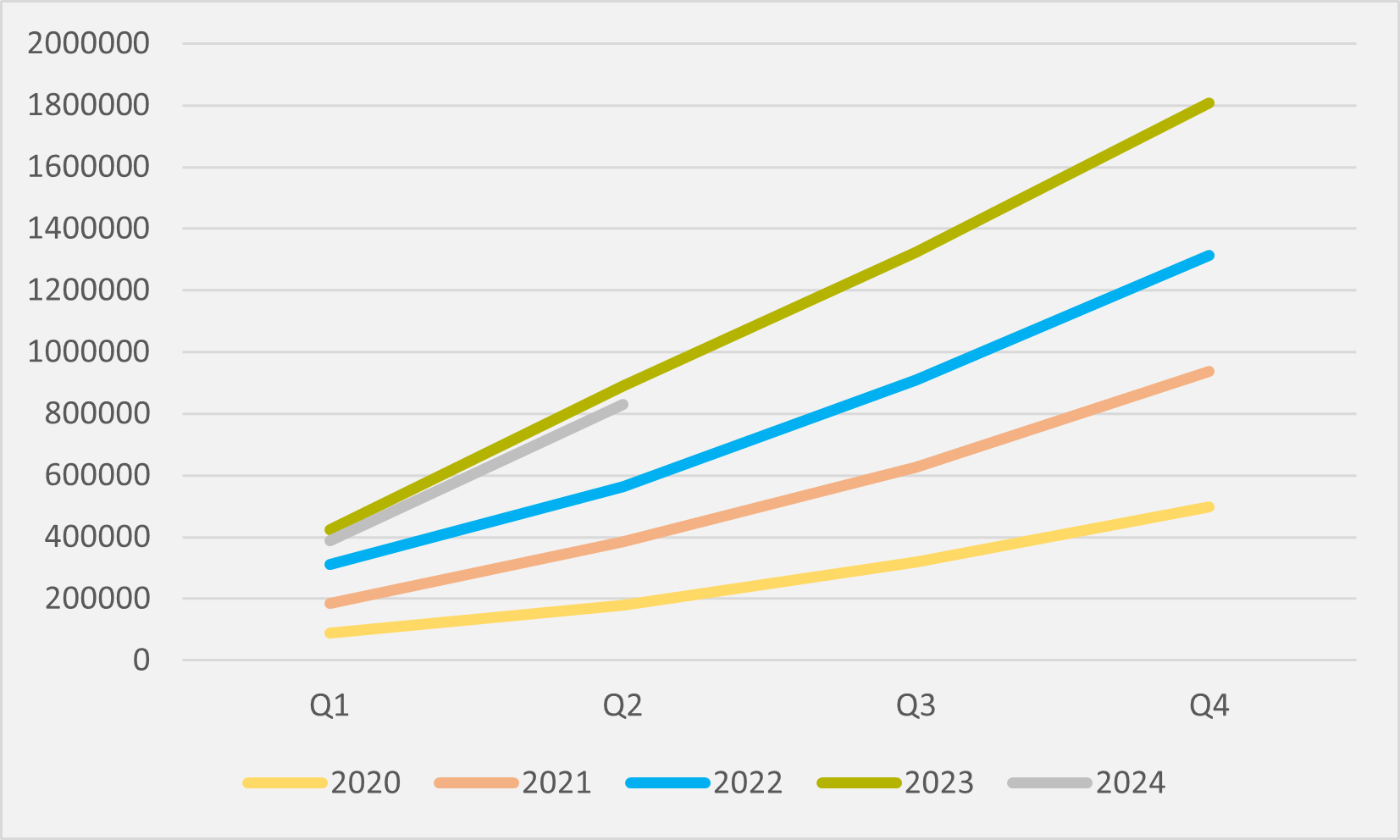

Only in Q2 and Q4 of last year has Tesla delivered more vehicles in a single quarter than the almost 440,000 it managed in the last three months (see main image). EV advocates will be relieved with the bounce back from sales of less than 390,000 units in Q1, with Tesla’s struggles relative to a still growing global BEV market threatening an outsized level of gloom.

But it is still not all good news. The firm has now sold almost 60,000 fewer vehicle for 2024 thus far as it did in the first half of last year (see Fig.1).

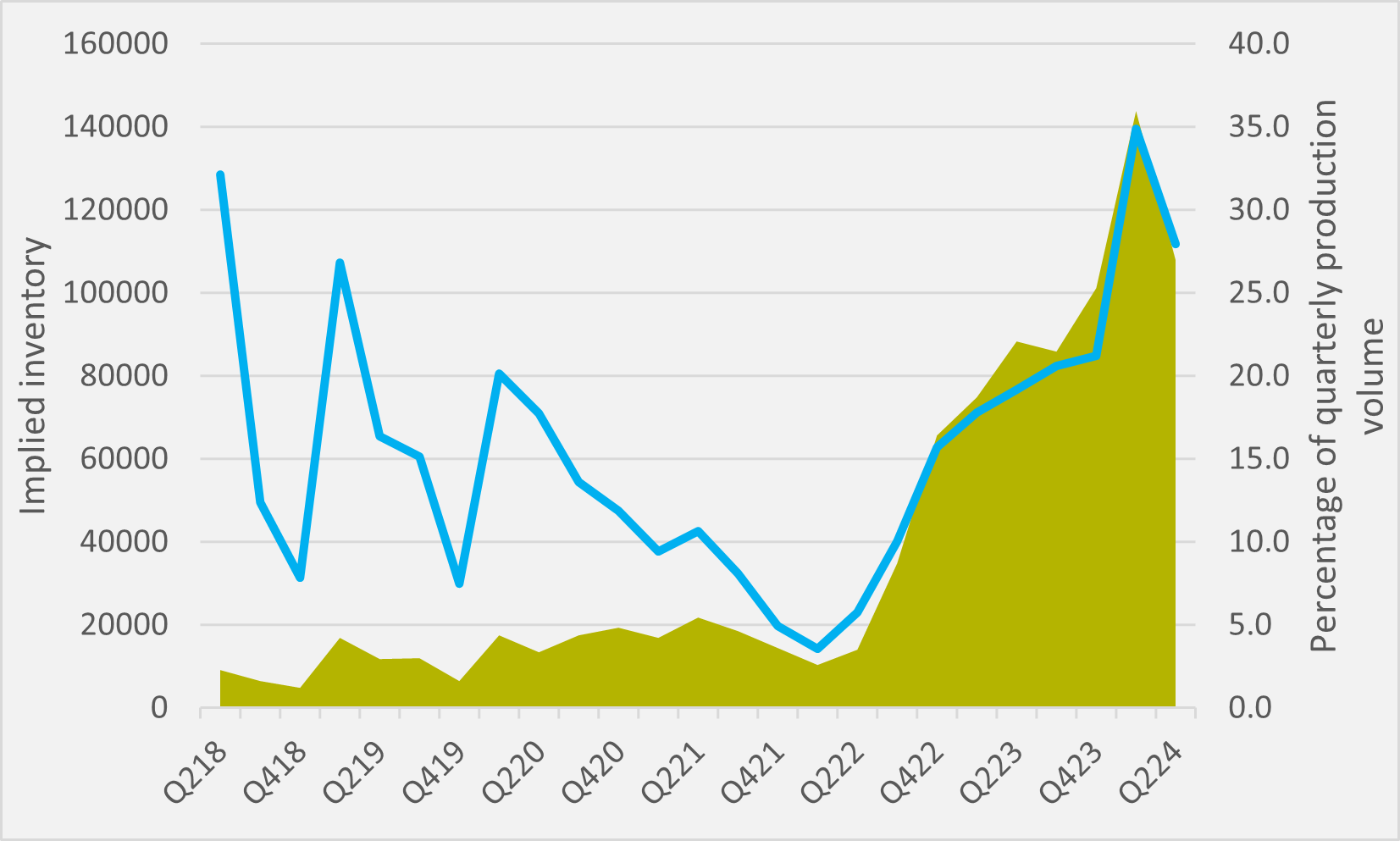

It produced fewer Model 3s and Ys than it sold, reversing the trend of an ever-growing implied inventory build-up across its two best-selling products. Implied inventory is now back at less than 108,000 units, or just under 28pc of Q2 production (see Fig.2).

Production of vehicles other than Model 3 and Y was the highest seen in a quarter since Q4’18, which might suggest that the number of Cybertruck e-pickups rolling off the lines is finally beginning to increase. But, at 24,255 units, compared to more than 385,000 3s and Ys, other vehicles, including Cybertruck, are still a negligible part of Tesla’s overall automaking.

Tesla sold more BEVs than its Chinese rival BYD, but the lead was trimmed compared to Q1. BYD shifted more than 425,000 all-electric units In Q3, just c.18,000 fewer than Tesla (see Fig.3).

Insider Focus LTD (Company #14789403)