Stellantis spins more positive Fiat 500e story

The conglomerate tries to get beyond reports of idled production

Another Chinese NEV challenger admits tough going

Nio has become the second Chinese new energy vehicle (NEV) maker in a week to confess to having overestimate Q1 sales, following on from peer Li Auto earlier in the month.

Nio says it now expects to sell 30,000 vehicles in the first quarter, revised from a previous outlook of 31,000-33,000 vehicles. Li said last week it expects deliveries for the first quarter to be in a 76,000-78,000 range, down from a target of 100,000-103,000.

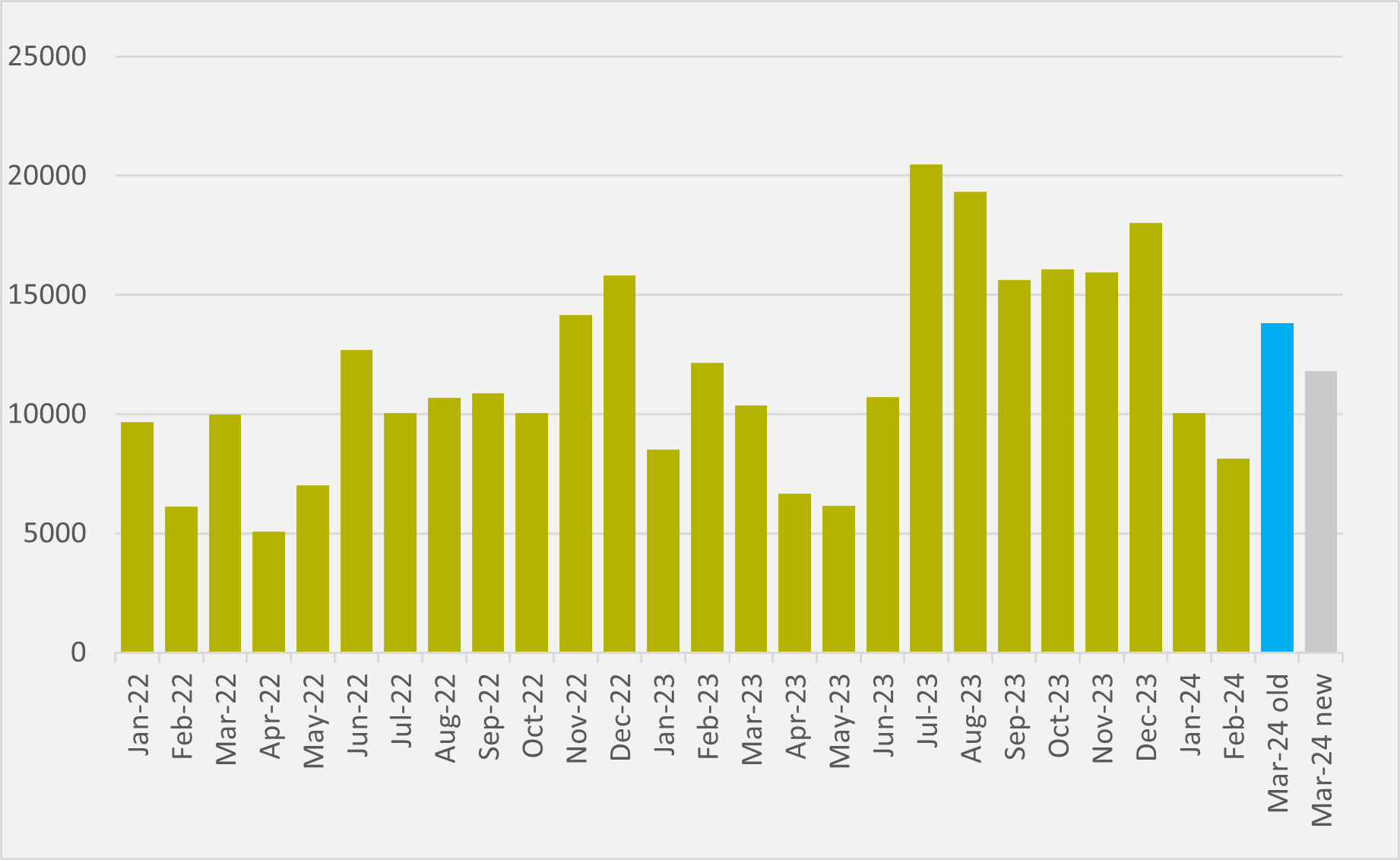

The revision means that Nio sales for March are set to come in at 11,813, rather than the 13,813 implied by the midpoint of the previous forecast (see Fig.1). It also means that Q1 deliveries will decline slightly year-on-year, rather than a modest increase as previously estimated (see main image). Both figures are far below the 50,000+ sales Nio achieved in Q3 and Q4 last year.

Nio has already faced scrutiny after its January and February sales, with New York-based brokerage US Tiger Securities revising down full-year sales expectations after the latter. It had been expecting Nio to deliver over 220,000 vehicles in 2024 — which would have represented another almost 39pc year-on-year rise in volumes — but in early March revised its forecasts down to just under 180,000, or an annual increase of c.12.5pc.

Wider challenges

And Nio is not the only Chinese NEV marker under pressure in an ultra-competitive market. After its January and February sales, Li would have needed a stellar 50,000+ performance in March — matching its record month in December — to meet target. Instead it revealed it expects to sell only half that number this month.

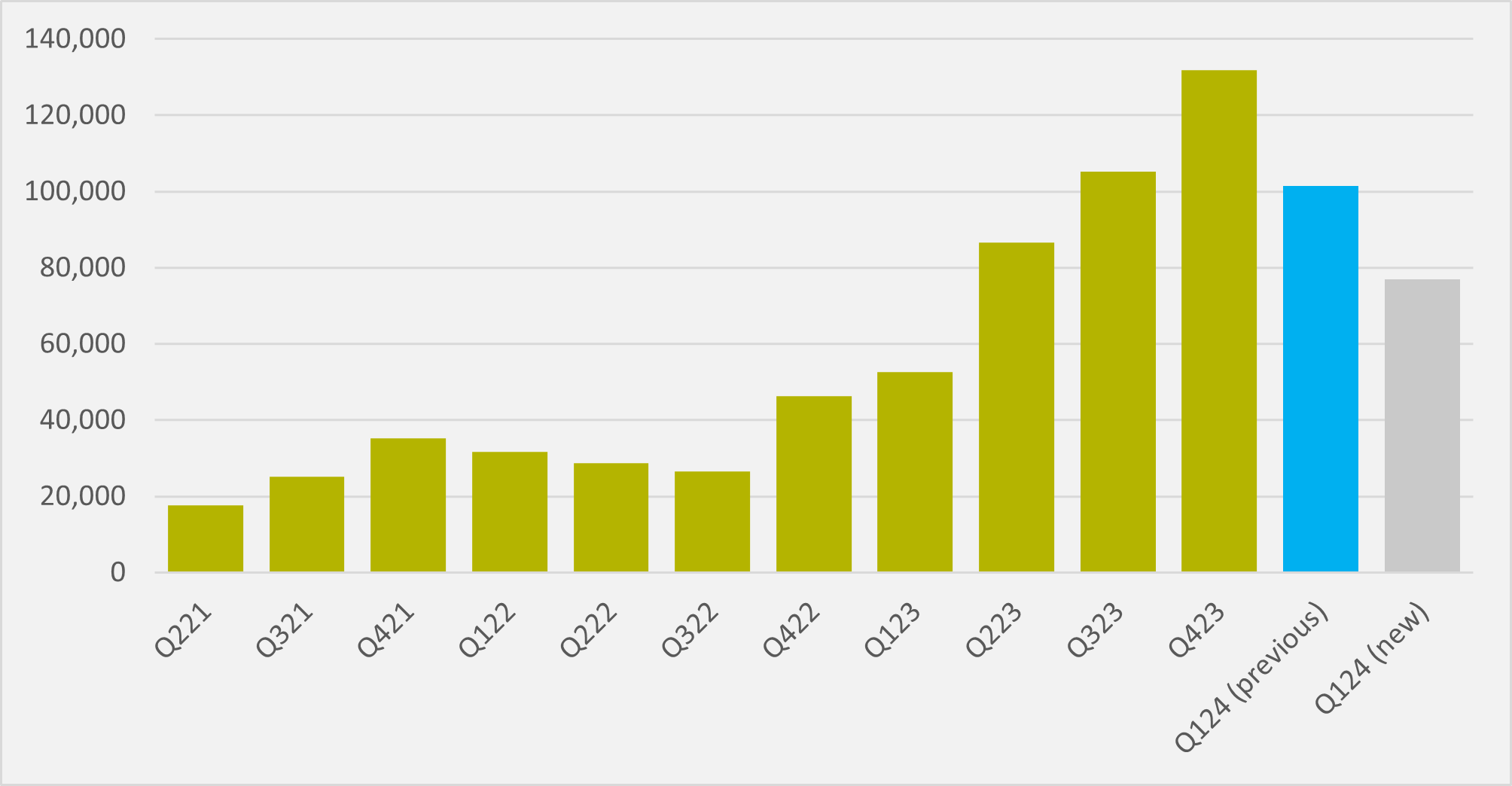

That means it will still have a stronger Q1 than seen last year, despite getting the year off to a slower-than-anticipated start. But it will be Li’s lowest sales quarter in four (see Fig.2).

The firm’s CEO Xiang Li admits mistakes have been made, especially around the launch of the Li Mega MPV, the firm’s first BEV — its other offering are extended range EVS (EREVs). “We want to acknowledge that the operating strategy of Li Mega was mis-paced,” says Li.

“We planned operations of Li Mega as if the model had already entered the 1-to-10 scaling phase, while, in fact, we were still in the nascent 0-to-1 business validation period. Similarly to Li ONE and our EREV technologies, Li Mega and our BEV technologies will also need to undergo this 0-to-1 validation process,” Li continues.

His firm now intends to “focus on our core user group and target cities with stronger purchasing power, recalibrating the Li Mega strategy back to the 0-to-1 phase”. “After that, we will expand our reach to a broader user base and more cities,” he says.

Mega is currently at a 2,000 monthly run rate, below the company’s original expectation, but Li believes it could gradually increase to 4,000 by Q4, according to Bo Pei, a US Tiger Securities analyst.

But Li’s growth issues are not confined growing pains for the new launch. “We put excessive emphasis on sales volume and competition, distracting us from what we excel at — creating value for our users and driving operating efficiency,” Li continues. “We will lower our delivery expectations and restore sustainable growth by refocusing on enhancing user value.”

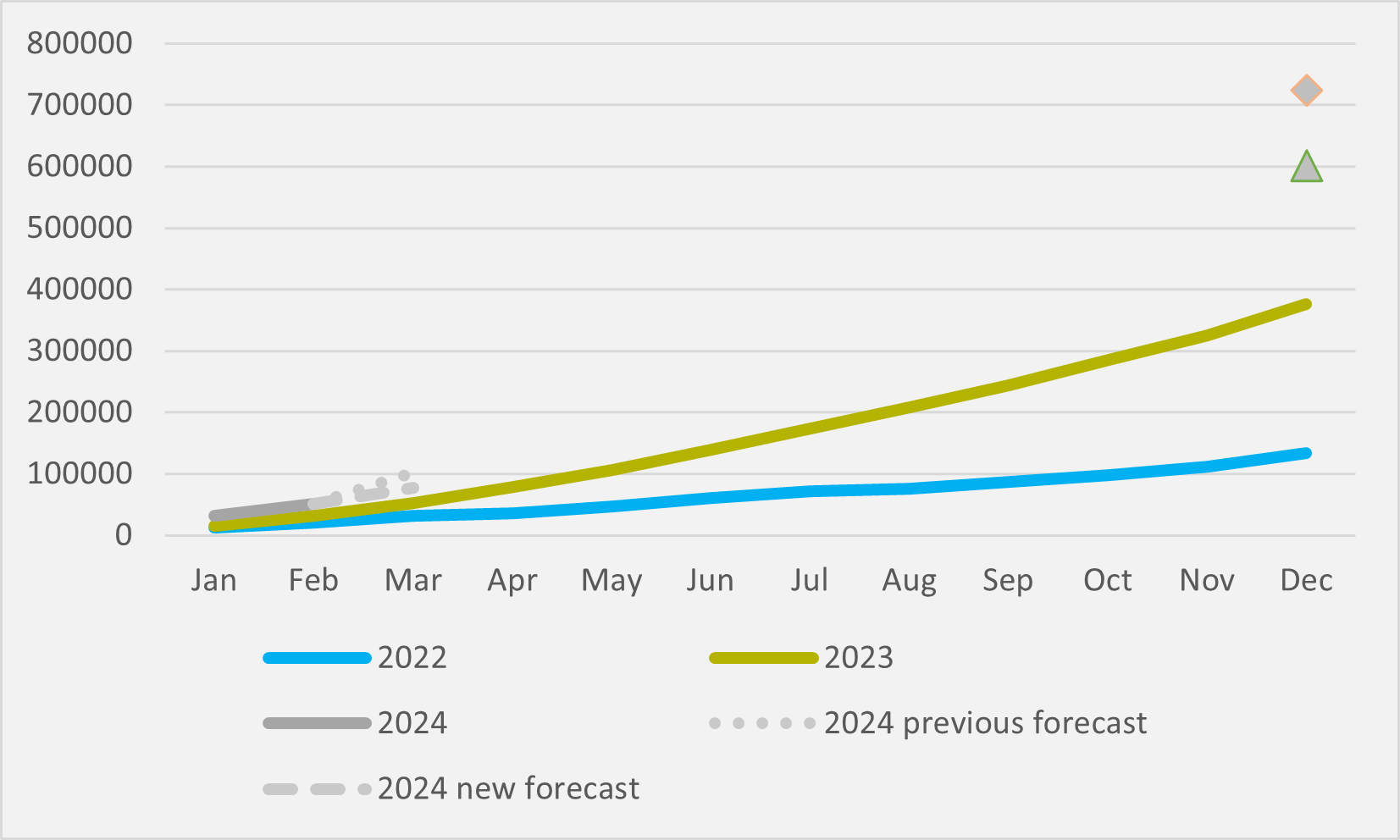

The firm now it expects total delivery growth to be 50-70pc year-on-year, compared to a previous 70-115pc, notes Pei. At midpoints, that would equate to a downward revision from almost 725,000 vehicles sold this year to c.600,000.

US Tiger Securities lowered its Li price target from $50/share to $40/share on the downward sales revisions. But it maintains a Buy rating as it believes 50-70pc year-on-year growth “is still healthy given the company’s size”.

Insider Focus LTD (Company #14789403)