Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

Silicon Valley could be gunning for the EV industry

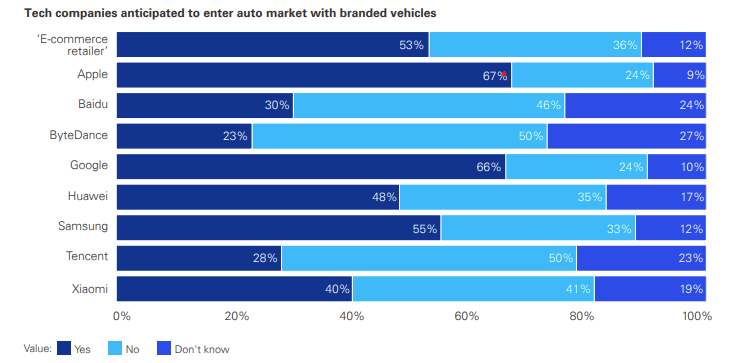

Up to two thirds of auto executives fear the arrival into the EV market of tech giants such as Apple and Google, according to a new report from consultancy KPMG.

In the executive survey, which reflects a general lack of confidence in profitable growth and the feeling that EV-ICE price parity without subsidies is far away, one driver of the pessimistic outlook is the worry that Silicon Valley is gunning for the EV industry.

"Most executives believe more tech companies will enter the industry with their own branded vehicles. Apple remains the number one choice, with 67pc, but it is now followed very closely by Google. Major global tech brands such as Samsung are also seen as likely competitors in automotive markets," KPMG finds.

"There still seems to be a good deal of fear and uncertainty about who can make it into the top ten — and who can secure a profitable share of market. Apple, which has not even confirmed that it will enter the market, is now expected to be in fourth place by 2030."

And the fears may be well founded. Big tech is already impinging on the EV space in China, where consumer electronics manufacturer Xiaomi recently unveiled an electric sedan called the SU7.

Fellow Chinese electronics firm Huawei announced in November it was moving into the battery space. It also has stakes in as many as six separate Chinese EV manufacturing joint ventures.

And South Korea's Samsung is already a core battery supplier in over thirty global EV projects, including with GM, Stellantis, and BMW. According to consultancy SNE Research, its Samsung SDI arm ranked fifth with 39.8pc growth in EV battery installations in the first 11 months of 2023, equal to 28.1GWh.

Apple has been long rumoured to be working on a car under a Project Titan codename. But little concrete is known about the project, and little has been reported since December 2022. South Korean OEM Hyundai did, though, in February 2021 admit that it had been in talks with Apple about a potential automotive partnership.

Google already has a much bigger auto industry footprint through its market-leading Waymo autonomous driving (AD) subsidiary. But Waymo is largely a software play — relying on fitting AD technology to vehicles made by OEMs such as, in past, Toyota and Stellantis, and now by the UK's JLR, rather than developing its own EVs.

Big tech prospects

And the question remains as to how well an EV from the likes of Apple or Google would sell. A product launched by either of the two of the world's biggest tech companies could certainly generate a wave of initial enthusiasm from early adopters.

But, beyond that point, any EV would have to prove its long-term viability as a consumer vehicle rather than just a PR stunt.

Pricing will be key, with newswire Bloomberg reporting in December 2022 that any Apple car would tip the scales at around or just under $100,000, which is not a viable price point for mass-market EVs.

But if big tech does get an EV to market, it may have a head start on incorporating AI into its vehicles — which could be an advantage as KPMG sees its penetration of the auto industry set to grow.

"We believe AI technology will likely touch virtually every aspect of the automotive business, from the way autos are designed and manufactured to how they are sold and driven," KPMG writes.

Enjoying EV inFocus? Hit follow on Google News to get us in your feed.

With EV market leader Tesla increasingly being — in the minds of some of its analysts — a technology company with a side job selling vehicles, the value proposition for features like advanced driver assistance systems (ADAS) and enhanced cabin interfaces and entertainment systems in EVs will only increase. And these are areas in which Apple and Google could feasibly excel.

But the biggest challenge in bringing a new BEV to market will likely be establishing its battery supply chain. And the decisive matter will be whether to seek out third-party suppliers for partnerships or vertically integrate.

KPMG sees tech giants as well positioned to disrupt traditional automakers in the space. Apple, for instance, has several of the ingredients already in place, having been reportedly working on ADAS since 2015, as well as releasing its Carplay in-cabin IOS interface.

And it has long-standing knowhow in batteries, albeit in consumer electronics. There is little doubt that Apple could roll out a car, but its commercial viability is another question.

In the interim, it is not just big tech that threatens to claim ground in the automotive supply chain, but up-and-coming suppliers, with whom KPMG urges automakers to strike partnerships, or else see their EVs fall behind in the age of the 'software defined vehicle'.

"Proactively identifying and cultivating partnerships with up-and-coming suppliers can help address critical strategic areas, from safety and security to advanced sensor technology and autonomous capabilities," KPMG suggests.

Insider Focus LTD (Company #14789403)