Why expensive power could soon accelerate, rather than retard, the US EV adoption divide

Thus far US BEV adoption has largely been strongest in areas that have higher residential power prices. What if that became a feature, not a bug?

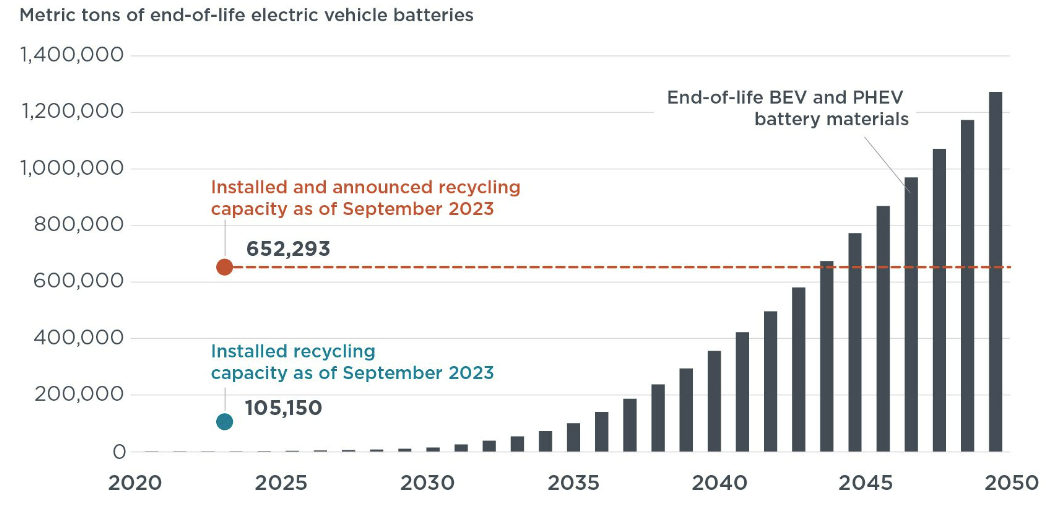

Existing and announced projects fit for purpose until the middle of the 2040s

The US is on track to increase its capacity for battery recycling to meet EV scrappage levels projected by 2044, says new research from thinktank the International Council on Clean Transportation (ICCT). A current surplus of capacity could serve until the mid-2030s, but additional facilities will extend the horizon even further.

“The 2023 operational recycling capacity should be sufficient to process end-of-life batteries from battery electric vehicles and plug-in hybrid electric vehicles up to the year 2036. When recycling plants announced as of September 2023 are included, sufficient capacity is available to recycle end-of-life batteries until 2044 (see Fig.1),” the ICCT says.

The research calculates that total annual capacity of installed and announced battery recycling projects is 652,293t of material. But current installed capacity as of September 2023 is just 105,150t/yr, revealing the scale of expansion planned.

There are currently eight lithium-ion recycling plants located in the US, according to the ICCT, the biggest of which, in Covington, GA, has a capacity of 30,000t/yr, equivalent to 70,000 EV batteries, with a further 12 projects announced.

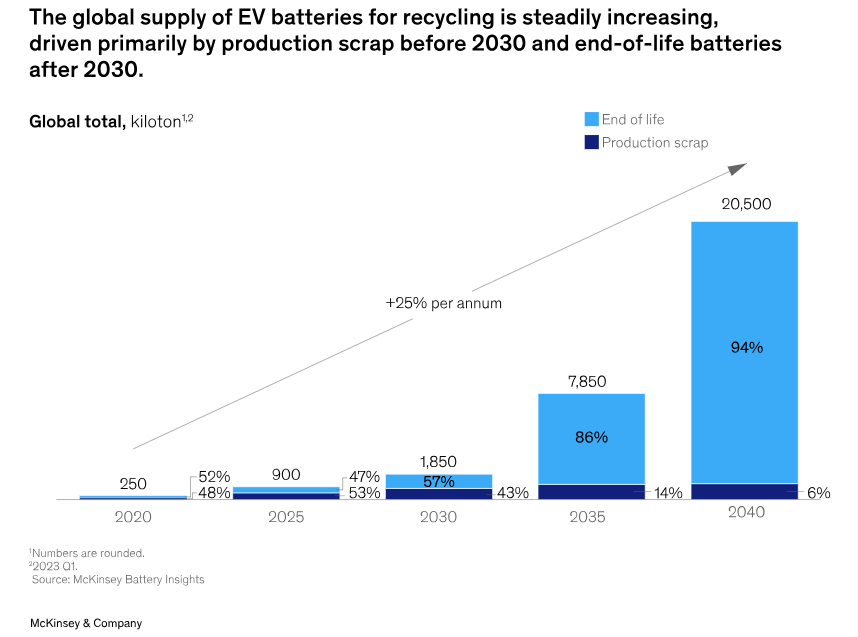

Consultancy McKinsey projects that end-of-life material will not make up the bulk of recycled battery inputs until 2030. Instead, production scrap — excess material left behind when batteries are made — will be at the centre of the industry.

McKinsey estimates that, by 2025, 900,000t/yr of battery materials will be recycled globally, 477,000t/yr of which will be production scrap. In McKinsey projections, this amount increases to 795,000t/yr by 2030, at which point end-of-life material will have overtaken it with 1.054mn t/yr recycled.

Circular economy

Despite the comfortable capacity situation, the ICCT still advocates greater legislative stimulus to support the US recycling industry’s development. For example, it calls for a wider rollout of California’s battery labelling requirements — under which manufacturers must clearly label batteries with information about their chemistry, cathode type, anode type, manufacturer, and date of manufacture, in order to streamline the recycling process.

The report also cites EU legislation that requires all new batteries to contain prescribed amounts of recycled material (16pc for cobalt and 6pc for lithium and nickel) as a model for future US legislation.

Joined-up forward planning is key, in the ICCT’s view, to maximising industry efficiency. For example, it lauds recycling plants “being built in regions where EV and lithium-ion battery production sites are already located”. “This creates a coherent ecosystem where the recycled material can easily be fed back into the lithium-ion battery and EV production lines,” the research says.

Both the ICCT and McKinsey see EV battery recycling only really ramping up in the 2030s, which is no great surprise given average vehicle lifetime estimates of c.15 years and the relative lack of EVs sold prior to 2015. By 2040, the consultancy expects the annual volume of recycled battery materials to have risen to 19.3mn t by 2040 (see Fig.2).

And that makes the prize of a circular battery industry a significant one. “The resources required for battery packs can be endlessly recycled for 70pc less emissions than a new pack so that, when we get to a steady state of production and retirement of EV batteries, actual mining and refining of battery materials can be essentially stopped. That is what a circular economy in battery materials looks like.,” says Glenn Garry, president of Canadian non-profit the Victoria Electric Vehicle Association.

Such a system would reduce the ecological impact of critical mineral mining significantly, as well as helping the US minimise its dependency on foreign mineral extraction. Indeed, the ICCT projects that “an efficient recycling of end-of-life vehicle batteries, in some cases after their prolonged usage in second-life applications, could reduce the combined annual demand in new lithium, cobalt, nickel, and manganese mining by 3pc in 2030, 11pc in 2040, and 28pc in 2050”.

Insider Focus LTD (Company #14789403)