Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

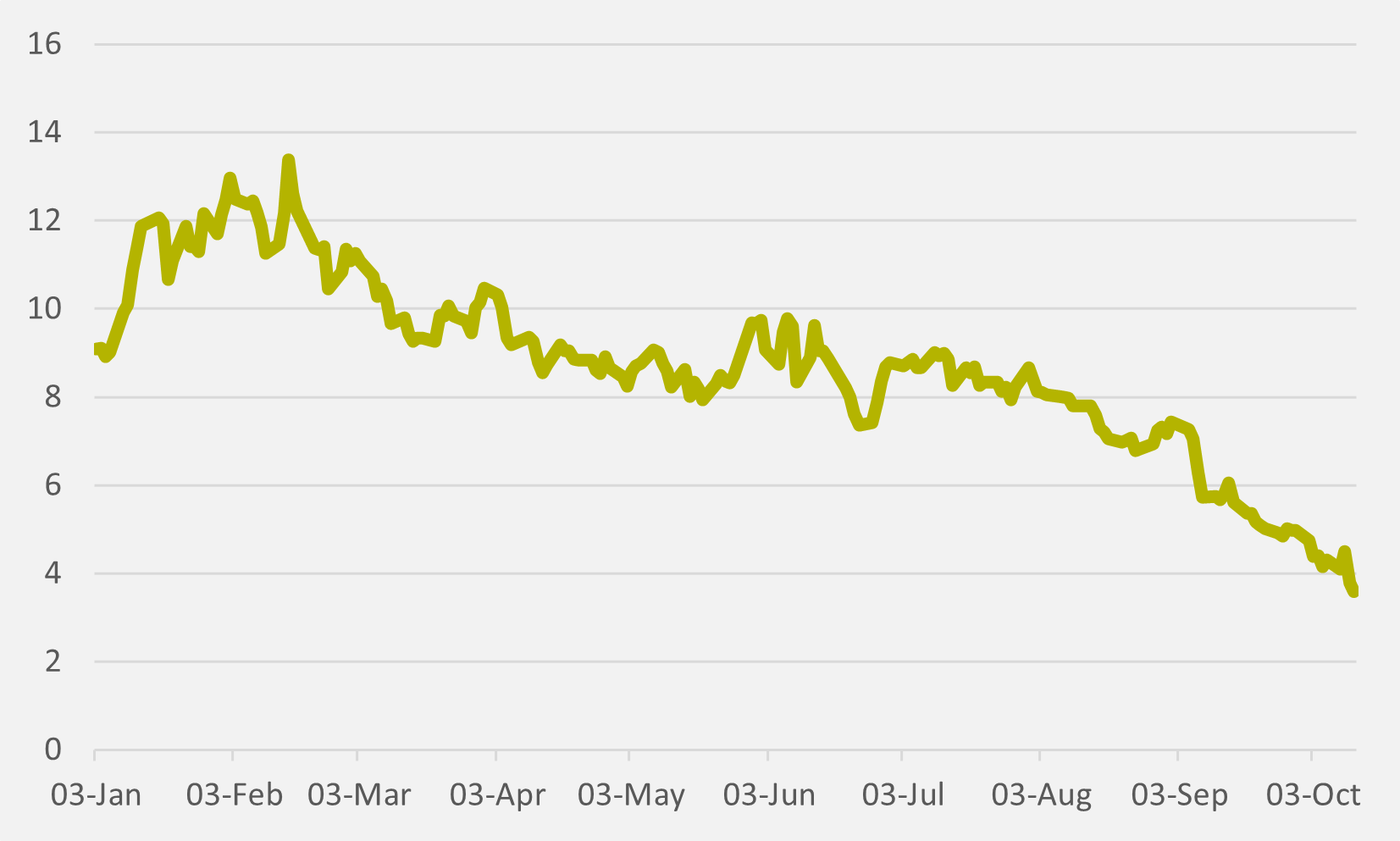

The EV charging firm’s stock has now halved from pre-Q2 results levels

US charging firm Chargepoint has secured a $232mn capital raise but an adverse equity market reaction sent the company’s shares down by 16pc in a single day’s trading this week. The raise consists of the sale of $175mn of common stock plus an additional $57mn from the company’s ‘at the market’ (ATM) offering facility which was secured earlier in the quarter.

The injection of cash is a significant boost to the $264mn in hand with which the company finished the second quarter.

The stock has been purchased by institutional investors, chief among which is the same investor which bought $300mn worth of convertible notes from Chargepoint in April 2022.

Chargepoint is targeting Ebitda profitability in the fourth quarter of 2024, a goal which the company reiterated even after margins shrank from 17pc to 1pc year-on-year in the second quarter. The precipitous fall in margins was attributed by the firm to a one-off charge taken on inventory of “a particular DC product” which lost its sale value, and therefore expects margins to recover quickly.

The company’s stock fell by some 20pc in three days of trading following the Q2 results announcement, however, and has since fallen by more than 50pc from its levels before Q2 results on 6 September (see Fig.1). Shares finished Thursday trading at $3.58.

Chargepoint stresses that the stock offering had been planned and was not a measure to secure emergency liquidity. “These raises and our recently announced $150mn revolving credit facility are consistent with our announced capital strategy to bolster our balance sheet,” says company CFO Rex Jackson. “We have no further plans to access the ATM.”

On top of Chargepoint’s existing cash levels, the new capital injection is expected to support the company through 2025. But the cautious reaction from the markets may reflect a concern that this will not be a one-off stock offering, and that the company’s shares may be diluted by further offerings.

In a separate agreement, Chargepoint also altered the maturity date of a previously agreed convertible note offering. The notes will now mature a year later than previous agreed (April 2028) in exchange for higher interest rates and a halving of the conversion price of stock.

Prospects

Chargepoint currently operates over 35,000 charging station locations in the US and Canada, with all but 2,500 stations being Level 2 charging. This gives Chargepoint just under a 52pc market share of all public stations, and a 55pc market share of public Level 2 charging locations.

Some analysts have maintained that this heavy presence in the Level 2 market, in addition to Chargepoint’s unique business model of not being owner-operator but instead selling pre-networked chargers, sets up the company to benefit for the upward curve of macro demand. Analysts from investment bank UBS upgraded its rating for Chargepoint, albeit partially on the basis that the current headwinds the company is experiencing creates an attractive risk/reward scenario for Chargepoint stock.

Insider Focus LTD (Company #14789403)