Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

Six-figure BEV sales and stagnant ICE registrations encouraging signs for EV uptake

March BEV registrations in the US topped 100,000 for the first time in 2024 and only the fourth time ever, as a strong month for the country's all-electric light vehicle sales defied some of the ongoing growth slowdown narrative.

BEV sales grew by 13.5pc year-on-year to reach 101,720, according to data from the Department of Energy's Argonne National Laboratory. This amounts to a 7.1pc market share, which is an increase in both year-on-year and sequential terms. The first quarter of 2024 saw 7.8pc growth over the same period of 2023.

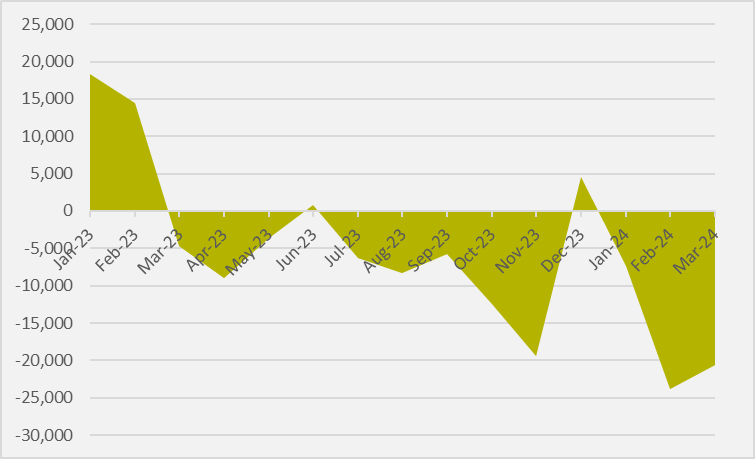

Seasonal trends mean that March is often a stronger month for the automotive industry than the two months preceding it. BEV sales in the first quarter of 2023, for example, increased by approximately 10,000 units each month between January and March. But month-on-month growth between February and March 2024 is just shy of 20,000 units, indicating that March was a strong month for BEVs even considering the expected seasonal jump.

Furthermore. the overall US car market grew by 4.6pc year-on-year in March, well below BEV growth of 13.5pc, indicating that BEV appetite remained robust relative to other powertrains. ICE registrations, in contrast saw less than 1pc year-on-year growth.

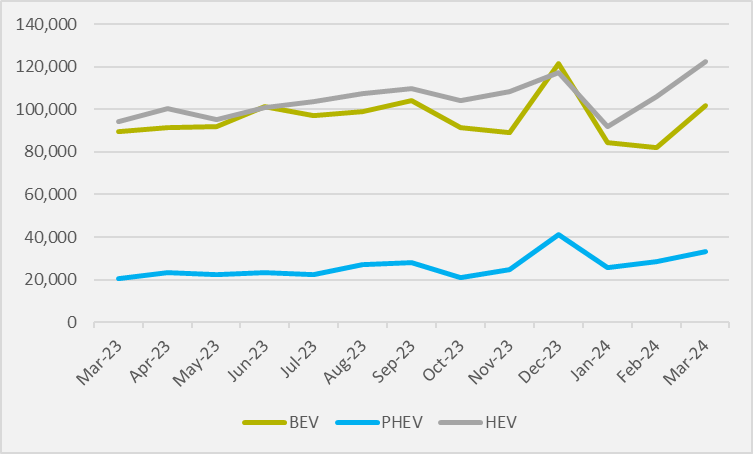

But while all electrified powertrains saw year-on-year growth, BEVs made captured the smallest proportion of sales growth outside the almost stagnant ICE market. Increases in HEV registrations (+29.7pc) and PHEV registrations (+62.2pc) show that consumer desire to shift away from ICE is translating more strongly into new hybrid sales than BEV sales.

BEV sales have consistently trailed those of HEVs since the beginning of 2023, with the exception of two isolated months in which battery vehicles marginally pipped hybrids (see Fig.2).

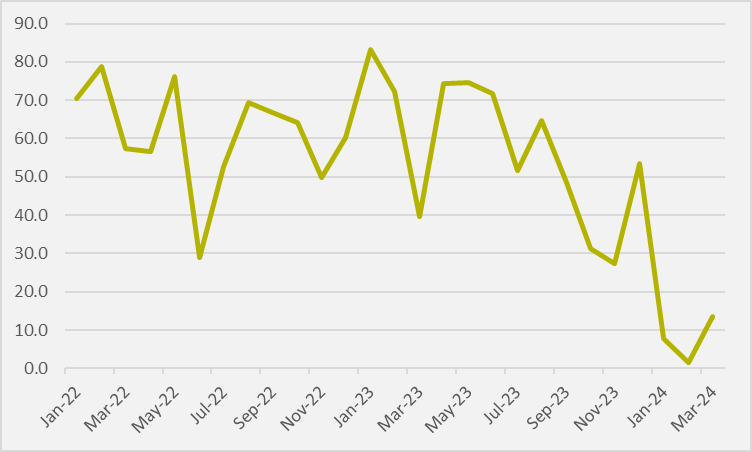

Against the backdrop of a what is broadly speaking a slowdown in BEV growth across the US and European markets, though, March is cause for encouragement because it is the first double-digit year-on-year growth month of the year (see Fig.3).

However, when viewed alongside the year-on-year growth seen across 2023, which routinely hit above 50pc, March's figures do not reverse what is markedly a slowdown in a broader context, despite being a material uptick compared to the beginning of 2024.

But the relatively strong overall BEV sales performance in March begs the question of which BEVs consumers are buying. US OEMs have recorded slumps in their EV sales throughout the first quarter, with EV leader Tesla posting its first year-on-year volume decline since 2020 and Detroit manufacturer Ford still finding material BEV growth elusive. New challengers are emerging into strong positions in the US market, though, with the likes of South Korea's Kia doubling its BEV sales in March.

Insider Focus LTD (Company #14789403)