Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

CEO makes the case for ‘long-term opportunities’

Eponymous CEO Henrik Fisker has rebutted market scepticism about his company, even as shares of the California EV maker dropped by another 10pc to open Thursday trading at $1.41 /share,

The equity story appears ever bleaker for the automaker, as it stock hovers 80pc below its January level (see main image). But CEO Fisker has released an impromptu statement to make the investment case for the automaker.

“I believe the negative reports about the company have been overblown,” Fisker says.

The most problematic headline that came out of a business update last week was that “Fisker has made a strategic decision to reduce December production to prioritise liquidity to unlock over $300mn of working capital, which creates additional business flexibility”. “As a result, Fisker is adjusting production guidance to just over 10,000 units for 2023,” the firm admitted.

Although in the immediate aftermath of the update, Fisker shares bounced by 12.5pc, they have been in steady decline ever since. Investors proved unable to look past the scale of the cutback, which was only the latest in a stream of production target revisions.

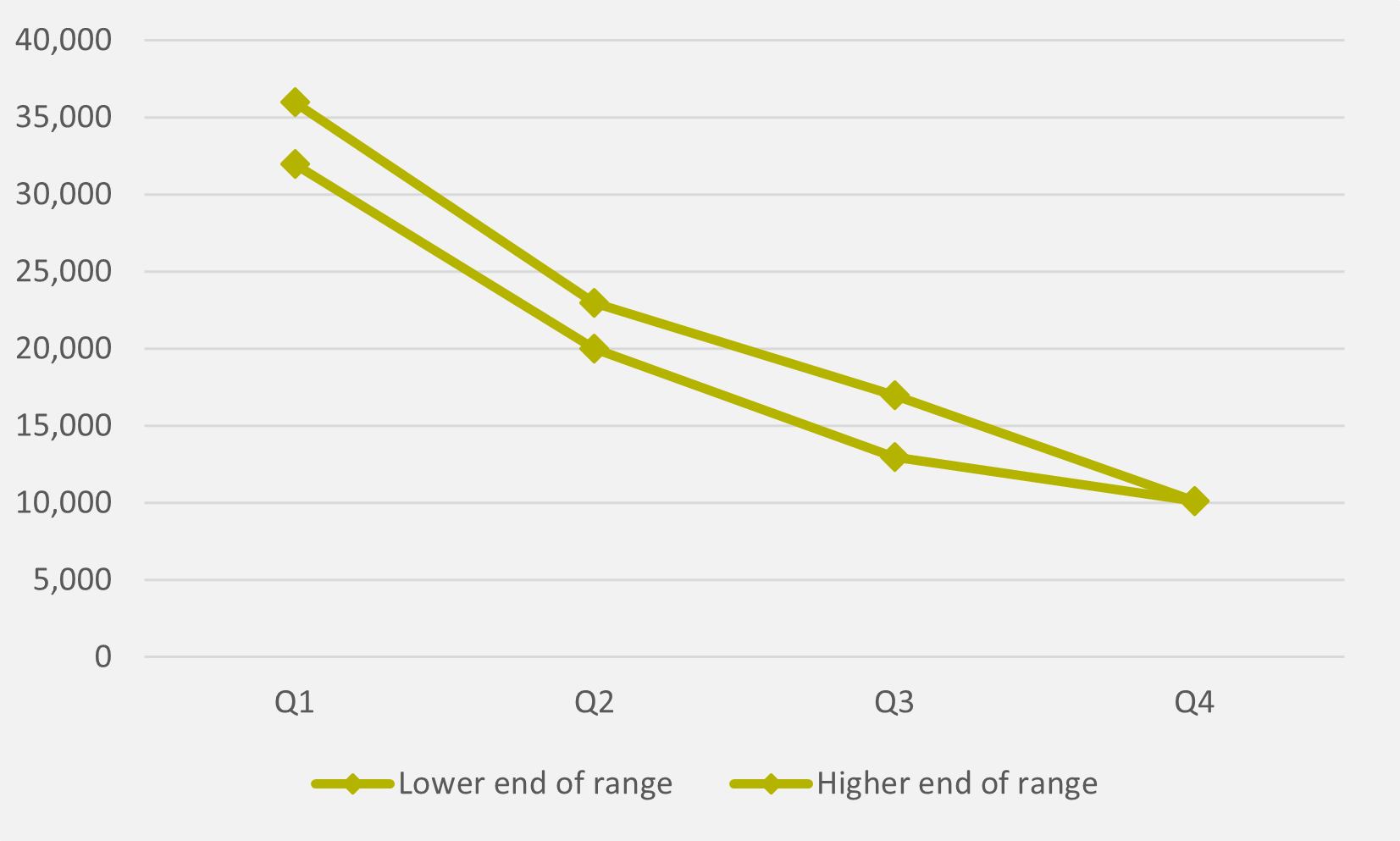

Indeed, the company’s guidance has been on a steady downward slope throughout 2023. Only three weeks ago at the company’s Q3 earnings call, it was revised down to a 13,000-17,000 range. The target was 20,000-23,000 at the previous quarterly call, which in turn was a shadow of the 32,000-36,000 range initially given at the end of Q1 (see Fig.1).

This leaves Fisker’s current production target at 28pc of what it was compared to March's high case, but the CEO assures investors that the company’s long-term case is sound.

“Fundamentally, our business is making positive strides each day and I believe we have compelling long-term opportunities,” Fisker maintains.

But these long-term opportunities will depend on the comprehensive scale-up of production and a broad market appeal to catalyse mass-market volumes. Instead, Fisker’s statement highlights only incremental progress made in the company’s expanding delivery services structures.

“We just delivered our first vehicles from our new Oklahoma and New York locations, and I am looking forward to sharing regular updates on our momentum. We plan the next business update later this month,” the CEO says.

There are also additional auxiliary revenue streams which the company is urging investors to consider, such as a credit selling scheme announced in the business update which the company will hope to leverage.

“Fisker is pursuing agreements with several major automakers to sell EPA greenhouse gas (GHG) emission credits. The company expects to generate 2.7mn GHG credits through model year 2025,” the company says, adding that “in Europe, Fisker has entered into a pooling agreement and expects to monetise credits for its 2023 vehicle registrations”.

But these opportunities pale in comparison to the core business of scaling and delivering EVs. And the market may also be spooked by the seeming inconsistency of Fisker management’s messaging. To open the Q3 earnings call, CEO Fisker talked positively about the firm’s production progress.

“We have a great manufacturing facility. We have great demand. The last part of the puzzle is getting these deliveries right,” he said. “Neither our production nor demand are limiting our deliveries, but rather it is the delivery and the service infrastructure,” agreed COO and CFO Geeta Gupta-Fisker.

When that was followed by yet another reduction in production guidance, it is perhaps no surprise that investors are losing faith in Fisker.

Nevertheless, management believes the company has an ace or two in the hole. Deliveries are ramping, with November selling more units than the whole of Q3, management says.

And the long-term investment thesis around the Pear crossover, which the company says will sell combine a $30,000 price label with being “the most exciting vehicle of the century under $30,000”, is an intriguing prospect – even if analysts are somewhat sceptical about the cost promises.

“We have made considerable progress on our business plan and achieved many firsts in the industry, including launching in 11 countries to date and delivering the most sustainable EV with the longest range in our category,” Fisker says.

Insider Focus LTD (Company #14789403)