Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

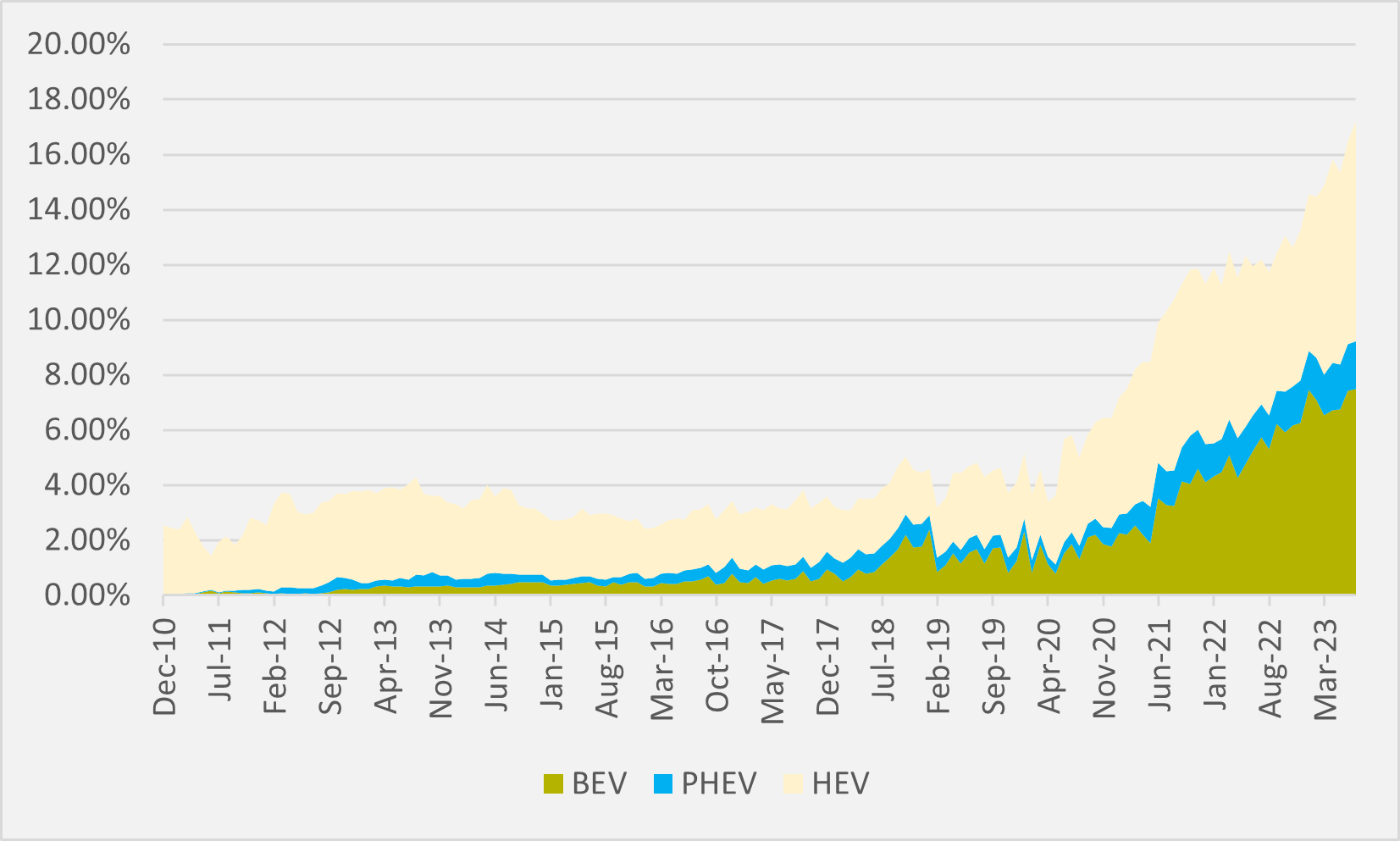

All of BEV, PHEVs and HEVs enjoy largest-ever slices of the US LDV pie in July

The number of pure ICE vehicles sold in July accounted to less than 83pc of all new light-duty vehicles (LDVs) for the first time in a single month, according to data published by the Department of Energy’s Argonne National Laboratory.

In total, 223,533 EVs of all hues were sold for an overall market share of 17.2pc (see Fig.1). BEVs made up 7.49pc of the mix, hybrids 7.98pc and plug-ins 1.73pc, all new monthly highs for each segment.

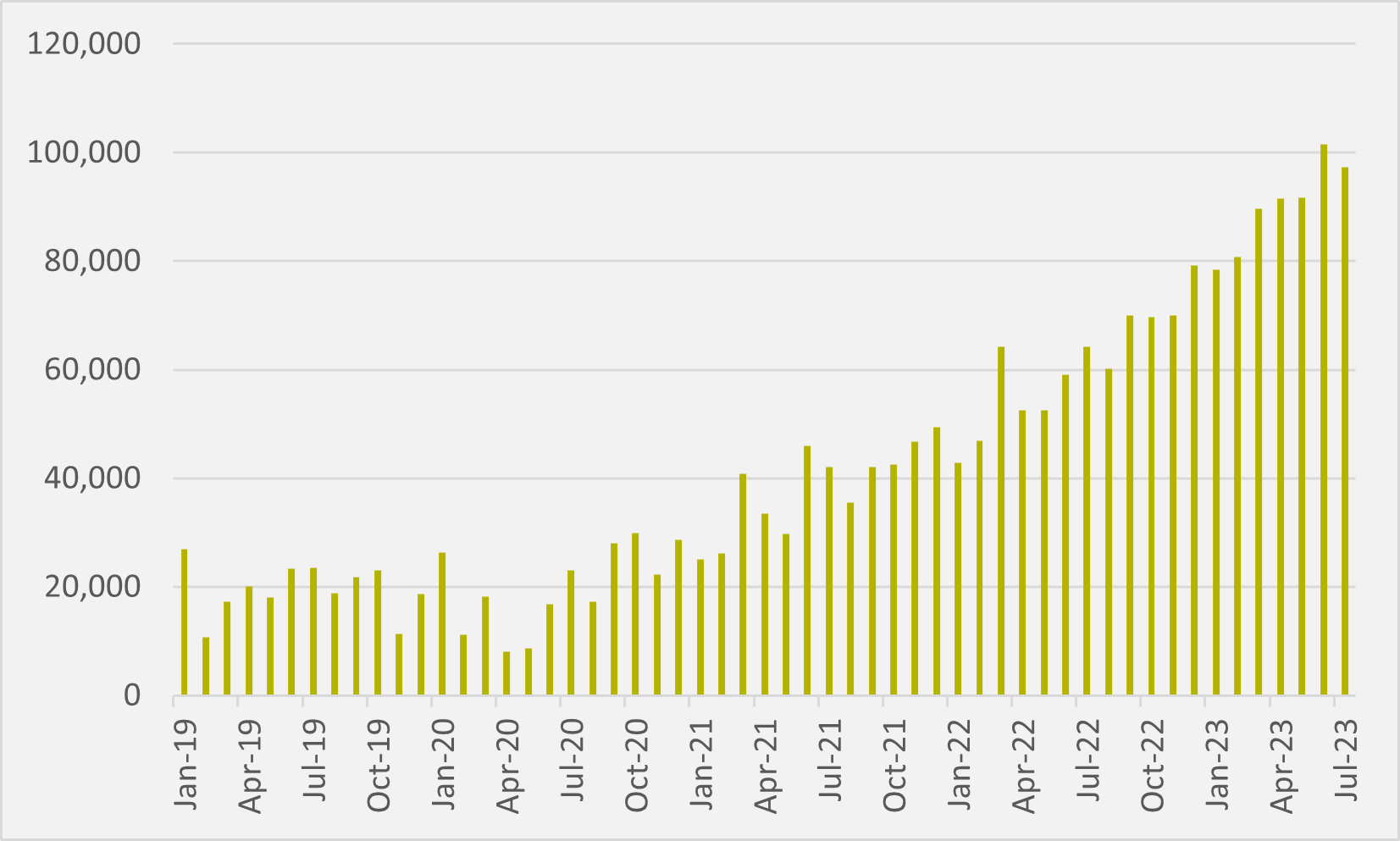

While the data shows a clear positive trend for EVs, BEVs failed to hold on to the six-figure milestone they hit for the first time in June, dipping back to 97,320, still the second-best month on record (see Fig.2).

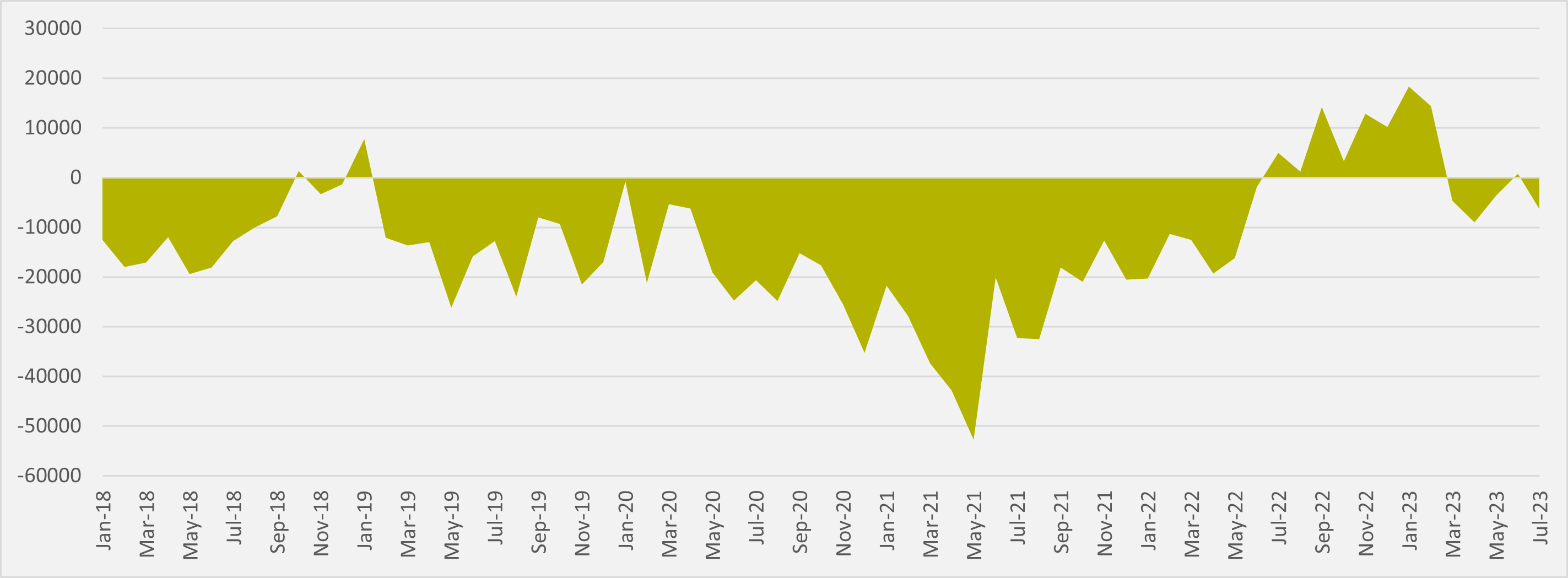

The HEV renaissance relative to BEVs also continued. The first month on record which saw BEVs bought exceed hybrid purchases was July 2022, but that sparked a run of eight consecutive months when all-electric vehicle sales eclipsed non-plug hybrids.

But three of the last four months have seen HEVs back in the lead (see Fig.3).

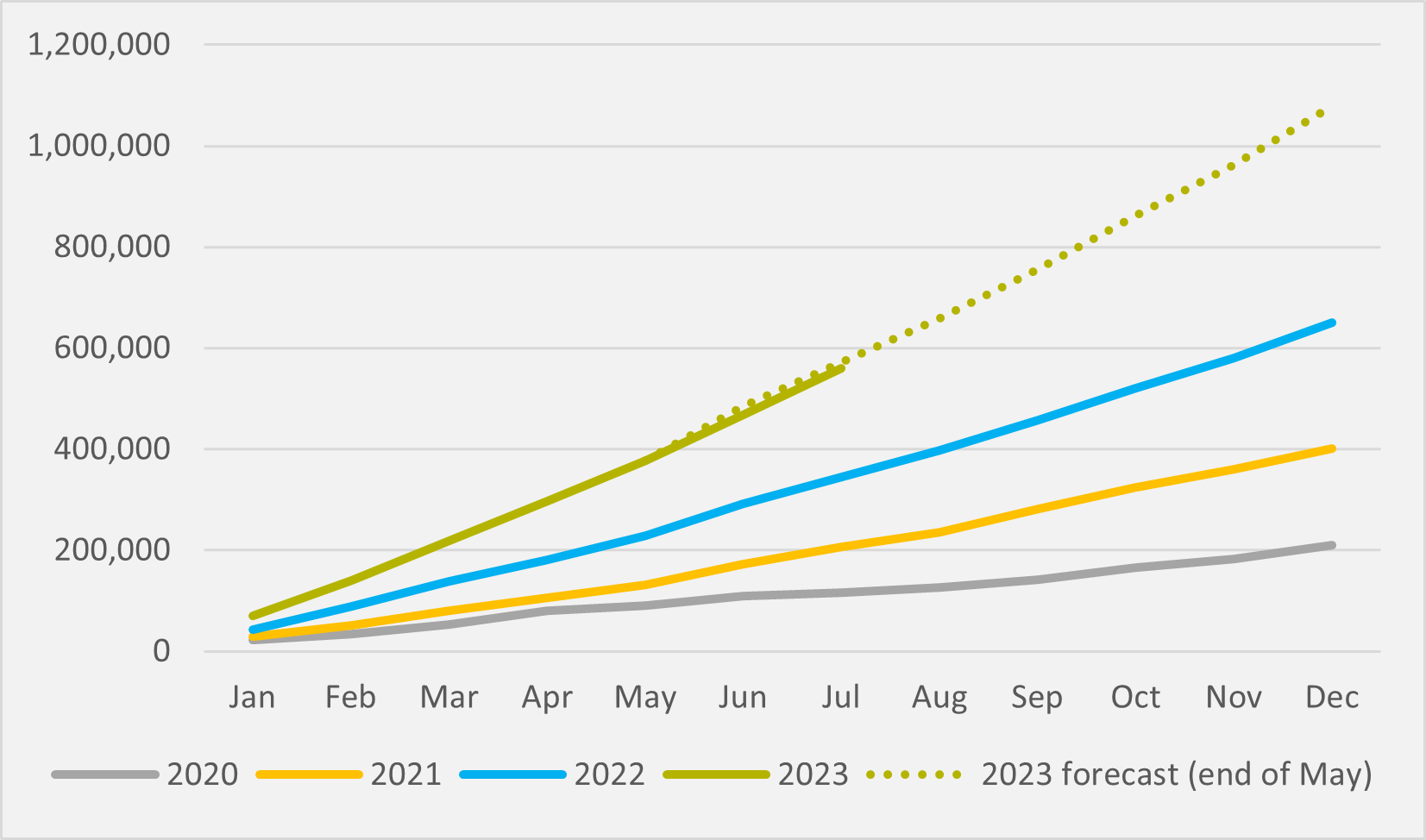

That said, after the DoE released May figures, EV inFocus projected BEV sales for 2023 as whole based on the rates of growth observed year-to-date. With two months of additional real data, numbers are tracking very close to that forecast, meaning US BEV sales for 2023 as whole are still on track to exceed seven figures for the first time (see Fig.4).

Market share

According to US consultancy Motor Intelligence, US OEM Tesla has retained its dominant position in US BEV sales in 2023 year-to-date. Motor Intelligence data, as reported by US broadcaster CNBC, has Tesla’s January-June volumes jumping by 29.7pc from just shy of 260,000 to over 335,000.

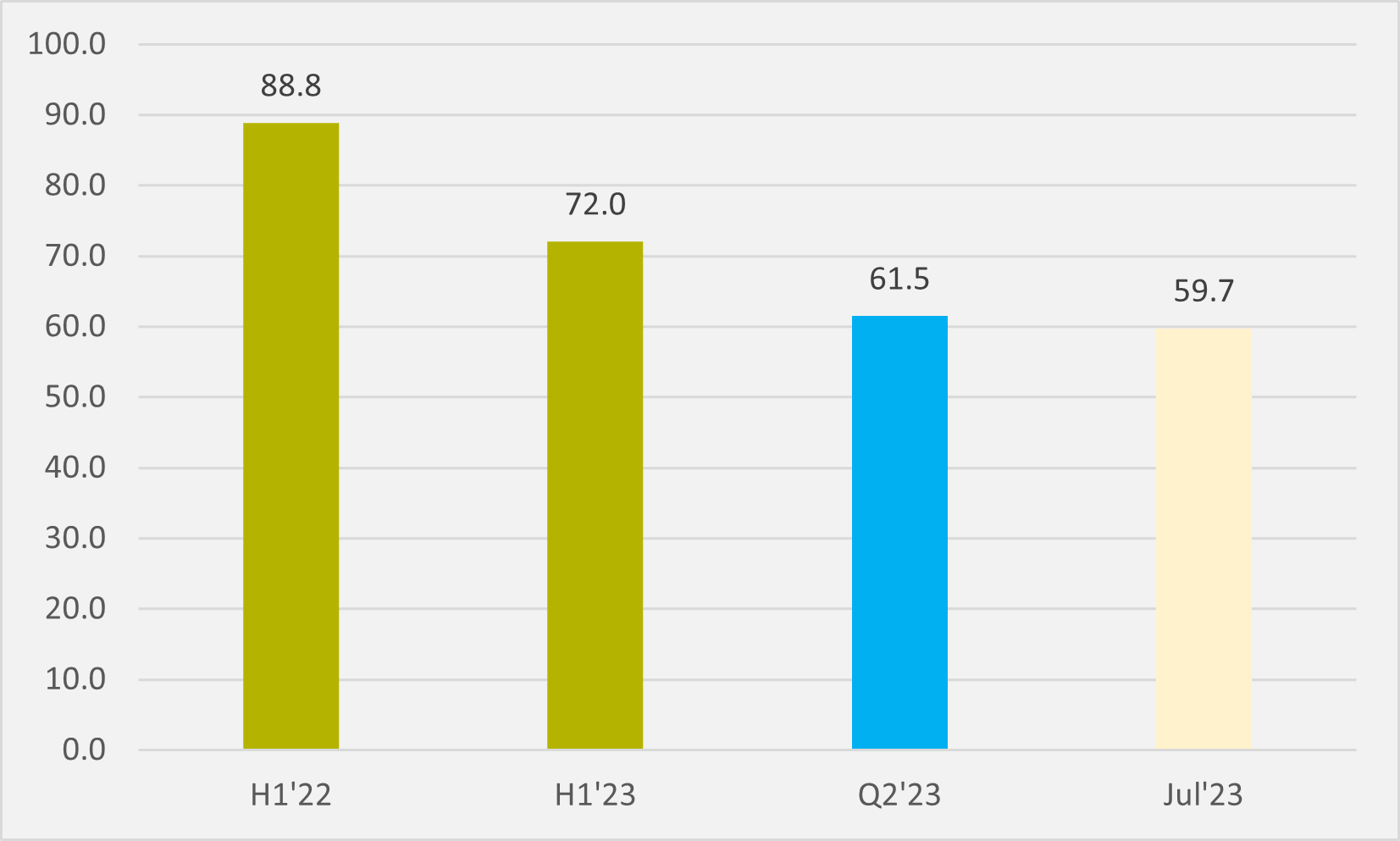

But that pace of its growth does not match the acceleration seen in the Argonne data for US BEV sales as a whole. Comparing Motor Intelligence figures for H1’22 with the Argonne total sales for the same period gives Tesla a market share of 88.8pc. Doing the same calculation for H1’23 sees the US EV pure play’s market share drop to 72pc (see Fig.5).

And that trend could be accelerating. According to another data provider, US consultancy Cox Automotive, Tesla’s US sales in Q2 were over 175,000. Plotting that headline figure against Argonne’s Q2 data sees the share of the pie for the Elon Musk-led firm drop to just 61.5pc.

Motor Intelligence estimate for Tesla’s US July figures is 58,142. Again, comparing this to Argonne data, the Tesla market share dips slightly further again, at just below the 60pc mark. Combining the firm’s H1 and July numbers for Tesla equates to a US BEV market share for the firm across the first seven months of the year of 70.6pc.

Insider Focus LTD (Company #14789403)