Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

Despite record month, UK growth held back by lack of private buyer incentives, auto lobby says

A figure of 3.8pc year-on-year growth in the UK BEV market belies the fact that the country has seen its best ever BEV sales month on the back of registering 48,388 new all-electric vehicles, according to data from trade association the Society of Motor manufacturers and Traders (SMMT).

While the growth number on its own will not blow anyone away, it must be contextualised as growth relative to the UK's previous strongest ever BEV sales month, which was March 2023.

The UK typically sees strong automotive sales months in March, September, and December, as the six best months on record for BEV registrations have all fallen in one of these months. The flipside of this, however, is that the UK is unlikely to record such strong BEV sales next month, as April is typically one of the weaker months of the year.

Despite the new record, the SMMT also repeated its call for government incentives to nudge private buyers towards BEVs, as growth was once again driven almost entirely by fleets.

"Market growth continues, fuelled by fleets investing after two tough years of constrained supply. A sluggish private market and shrinking EV market share, however, show the challenge ahead," says SMMT CEO Mike Hawes. "Manufacturers are providing compelling offers, but they cannot single-handedly fund the transition indefinitely. Government support for private consumers – not just business and fleets – would send a positive message and deliver a faster, fairer transition on time and on target."

ICE replacement

Despite improving on March '23 by 3.8pc, March saw BEV market share decline year-on-year from 16.2pc to 15.2pc, as the UK car market as a whole is growing more quicky than its BEV sales.

As such, petrol and diesel fuel together accounted for 63pc of new registrations in March. While this is down from 64.6pc in March '23, new BEVs are not materially displacing ICE vehicles but are rather to some extent supplementing them in a growing overall car market.

HEV sales also reached record levels, rising by 19.6pc year-on-year to 44,550 units and a 14pc market share. And PHEVs rose by more than a third to 24,517 units, equalling 7.7pc of all new registrations.

Year-to-date

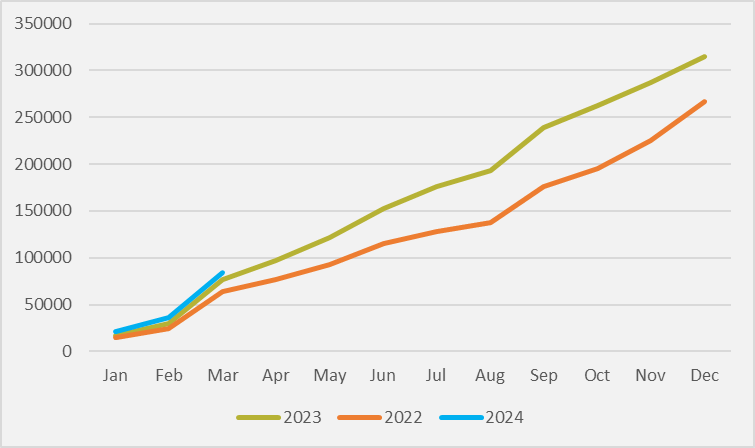

In 2024 to-date, the UK has registered 84,314 BEVs, 10.6pc more than at the same point in 2023 (see Fig.2). This figure is, however, materially below the full year-growth figure of 17.8pc seen for the entirety of 2023.

And a Q1 BEV penetration of 15.5pc is well below the 22pc of sales that must be zero-emissions from the tailpipe for 2024 in the UK's Zero Emission Vehicles (ZEV) Mandate scheme. But some 15,500 of these Q1 BEV sales are by electric-only sellers such as Tesla, Polestar, BYD, Smart, GWM Ora and Fisker.

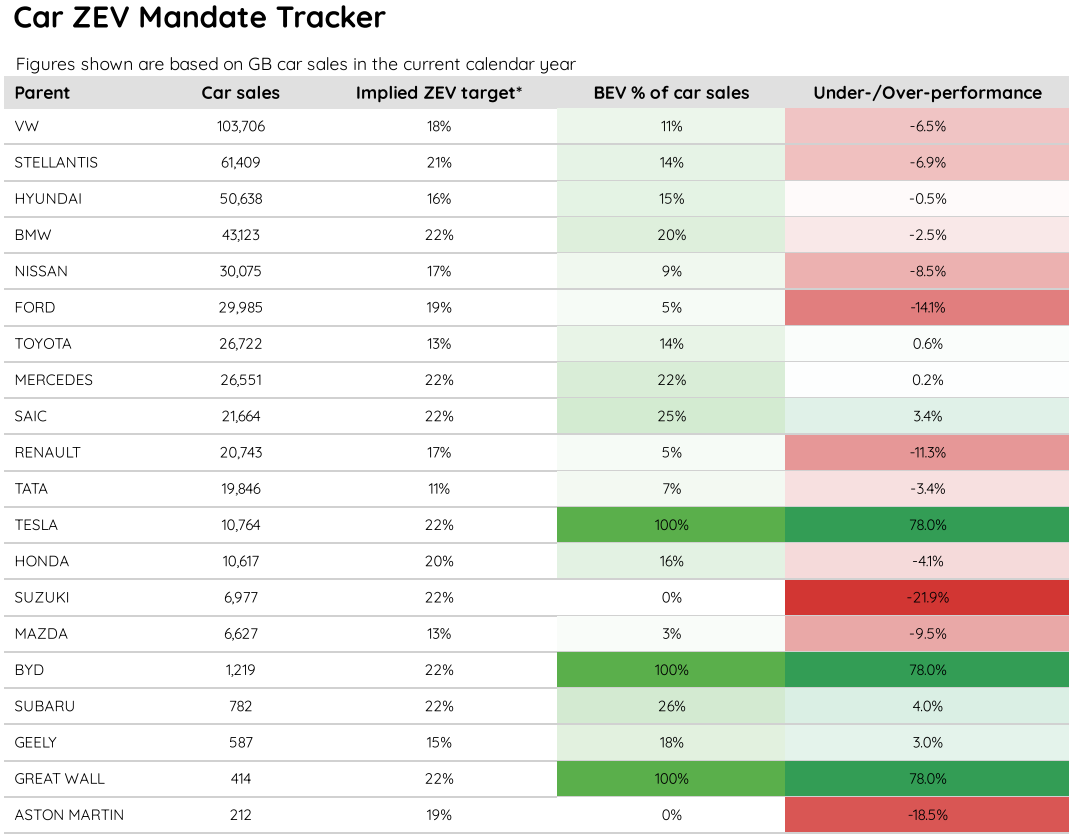

So the rest of the UK market that sells tailpipe-emitting cars as well as, or instead of, BEVs shifted only 68,810 of the BEVs sold in the UK in Q1, putting ZEVs at just 13pc of their sales. Consultancy New Automotive sees Ford, Renault, Nissan, Stellantis and VW as worst positioned relative to meeting their individual ZEV targets (taking into account additional credits they can earn by exceeding what New Automotive criticises as "easy-to-meet" CO2 emissions targets on their ICE vehicle sales).

Among smaller volume sellers, Japan's Suzuki and Honda and UK marque Aston Martin are laggards, according to New Automotive data (see Fig.3). Suzuki and Aston Martin saw zero BEV sales in the UK in Q1.

Perhaps surprisingly, it calculates that Japan's Toyota, often characterised as a BEV laggard, is actually ahead of its mandate targets. The firm's strong sales of hybrids are likely a factor in New Automotive assigning it a target of just 13pc of sales. With 14pc of total sales of 26,722 being all-electric — meaning the firm has shifted c.3,750 of its often maligned, even by the firm's own executives, Toyota bZ4X, its Lexus RZ and Lexus UX 300e — it is ahead of schedule so far.

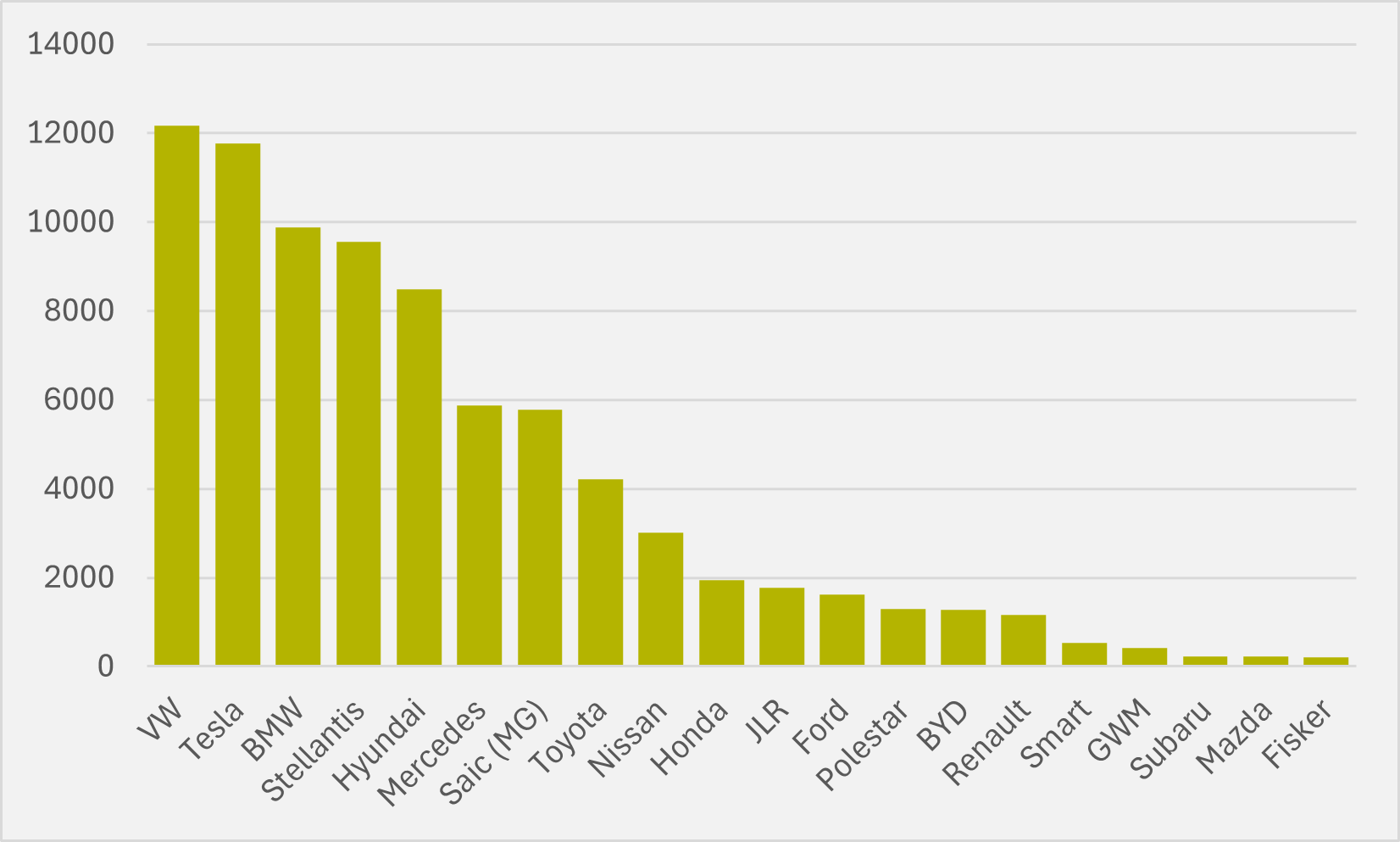

It is important to note that New Automotive's data is not entirely analogous to the SMMT's, possibly due to the consultancy compiling from data that does not go up to the end of the latest month. But, whether one compares New Automotive's Q1 sales and BEV percentages, or takes SMMT's potentially more complete sales figures and apply the New Automotive percentage to them both come to the same interesting conclusion: brands in the Volkswagen Group sold more BEVs in the UK in Q1 than Tesla did (see Fig.4).

These VW figures will include all-electric sales across the Volkswagen, Audi, Skoda and Cupra marques, so Tesla as a brand will still be the leader. But Tesla sales fell by a third year-on-year in March and are down by 12pc for the quarter as a whole. The firm had a 17.5pc share of the UK BEV market in Q1'24; in Q1'24 that dropped to 14pc.

Chinese OEM BYD, which recently told EV inFocus of a months-long UK order backlog, has sold 1,278 units in the UK in 2024 thus far, up from just 34 in the same period last year. It almost moved to power with Geely-controlled Polestar, which conversely saw sales of over 3,500 in the first quarter of last year to tumble to less than 1,300 in Q1'24.

Other Chinese-headquartered challenger brands Smart and GWM sold only in three figures in the quarter. But the clear Chinese winner for UK all-electric sales was Saic's MG, which achieved deliveries of c.5,800.

Just 207 UK customers in the first three months of the year took the plunge on a Fisker Ocean e-SUV. Will they live to regret their choice, should aftersales service and software updates dry up if the ailing firm cannot find a way out of its current troubles?

Enjoying EV inFocus? Hit follow on Google News to get us in your feed.

Insider Focus LTD (Company #14789403)