Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

Start-up reels in production to help tackle rising stock levels

US EV start-up Lucid reported a 40pc year-on-year increase in its Q1'24 deliveries, marking the automaker's first double-digit annual growth since reaching material production capacity, and marginally the firm's strongest ever delivery quarter.

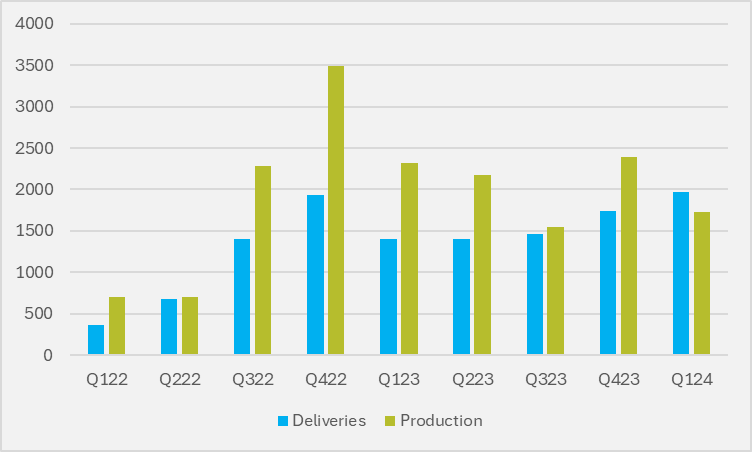

The company also delivered more vehicles than it produced for the first time in its history, selling 1,967 BEVs compared to 1,728 units produced (see Fig.1). On a less positive note, part of this was the firm's production missing analyst expectation of around 2,100, posting a quarter-on-quarter decline of 28pc.

Lucid has struggled with conversion rate concerns, and given that the company has mentioned no unforeseen production constraints for Q1, it may be the firm is throttling back on output to try to reduce its rising inventory.

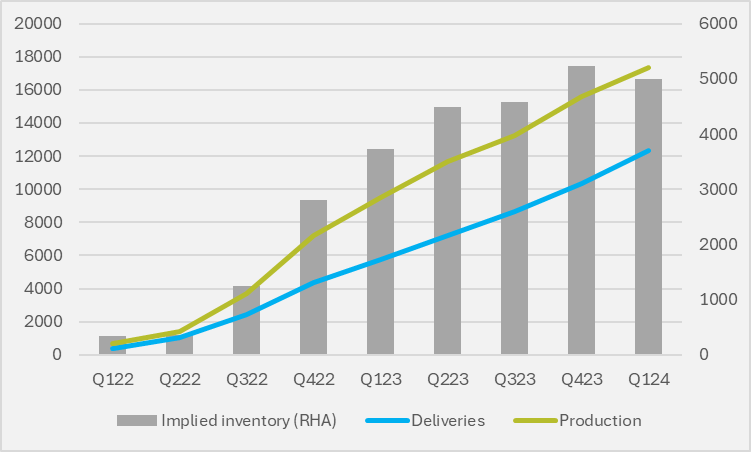

Since the start of 2022, Lucid has sold 71pc of the BEVs it has made. And it still faces an implied inventory of 5,000+ vehicles even after the Q1 reduction (see Fig.2).

In February, Lucid said it expects only a 6.7pc increase in production for full-year 2024 compared to 2023, in a move which the company says will better match supply to demand and improve margins.

"Moving to the outlook for 2024, we forecast production of approximately 9,000 vehicles in 2024, and we will continue to prudently manage and adjust our production to meet our sales and delivery needs," Lucid interim CFO Gagan Dhingra told investors on the automaker's Q4 earnings call.

The flat guidance marks an abrupt end to Lucid's output growth, as production for full-year 2023 saw a 17pc increase compared to 2022.

After turning out vehicles in small volumes in early 2022, Lucid appears to have overestimated immediate demand for its premium EVs. The company went from producing 1,405 in the first half of 2022, to producing 5,775 in the second half of the year.

Since then, the firm has been reeling in its production, with the last three quarters all seeing a c.30pc year-on-year decline. However, the last quarter is only time in this span that Lucid has seen a sequential decline in inventory, having decreased it 4.6pc from Q4 2023.

Lucid recently raised a further $1bn from its Saudi sovereign investment partner the PIF, giving it greater cash runway to sustain its current production and delivery levels. But demand remains the sticking point for the firm at its high price point. The automaker, however, is planning a $50,000 mid-size EV in 2026, which CEO Peter Rawlinson says will target Tesla as a competitor.

Insider Focus LTD (Company #14789403)