Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

French growth drives the region's numbers, while Germany's registrations stay depressed

New BEV registrations grew at twice the rate of ICE cars in Europe in April, as all-electric vehicles claimed a 12pc share of the region's market with 108,552 unit sales, according to data from the continent's automotive lobby, Acea.

With year-on-year growth of 14.8pc, BEVs significantly outgrew petrol and diesel cars, whose registrations rose only 7.3pc. BEVs even outgrew the EU's wider car market, which saw 13.7pc change.

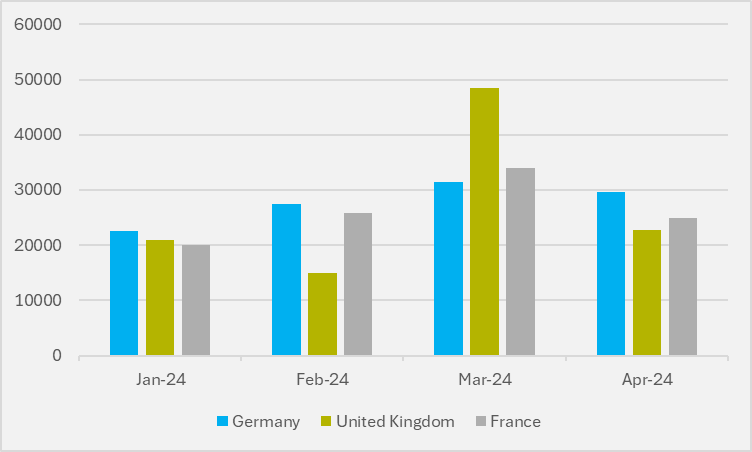

Of the approximately 126,000 BEVs registered in April in the 31-country EU+Efta+UK bloc, over 77,000 came in the three biggest markets, the UK, France, and Germany (see Fig.1), despite sequential declines — as one would expect between a traditional stronger sales month in March and a weaker one in April — in all three countries.

France continues to drive a significant portion of the continent's all-electric registration growth, recording a 45pc increase compared to April last year, while the UK posted a solid figure of 10pc annual progress.

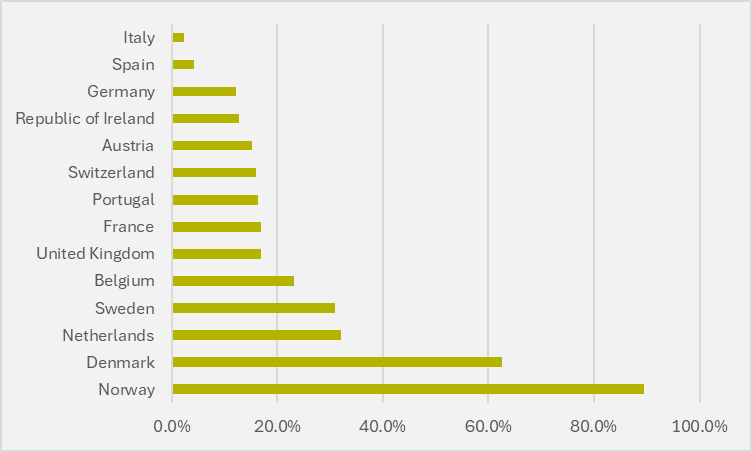

Also among the top growers in year-on-year registrations were Belgium with 41.6pc, Denmark with 89.8pc, and Portugal with 40.7pc. And it is medium-sized BEV markets like these which lead the way in terms of market share across the continent, with Denmark crossing the 60pc market share threshold for the first time and Norway sustaining a share of just under 90pc (see Fig.2).

Germany stutters

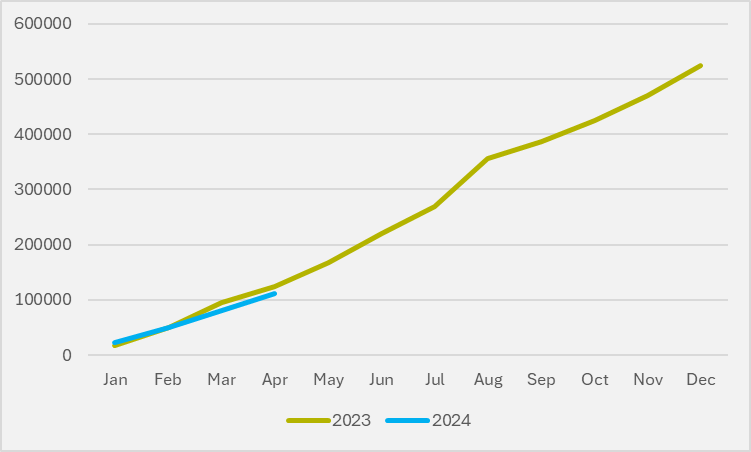

Germany's woes continue as the country posted the second consecutive month of negative year-on-year growth in BEV registrations, although April's meagre negative growth of 0.2pc is a marked improvement over the contraction of 29pc year-on-year seen in March. A material gap of 10.8pc has now opened up between the country's 2023 and 2024 year-to-date sales (see Fig.3), as the lack of BEV purchase subsidies, which ended suddenly in December, begins to rear its head.

Germany is nevertheless the continent's biggest BEV market in April, as despite the healthy year-on-year growth in France and the UK , neither country could match the overall level of new BEV registrations that Germany hit last month.

Insider Focus LTD (Company #14789403)