Timetable for more affordable Tesla slips further

Musk no longer dangling the possibility of a 2024 rollout of his firm’s new offering

Losing Q4 sales crown to BYD will not dampen Tesla's industry leader status

Shares of Elon Musk's EV market leader Tesla are down by 16.3pc since late December, in part as markets react to headlines of the firm's automotive deliveries falling behind Chinese rival BYD in the fourth quarter.

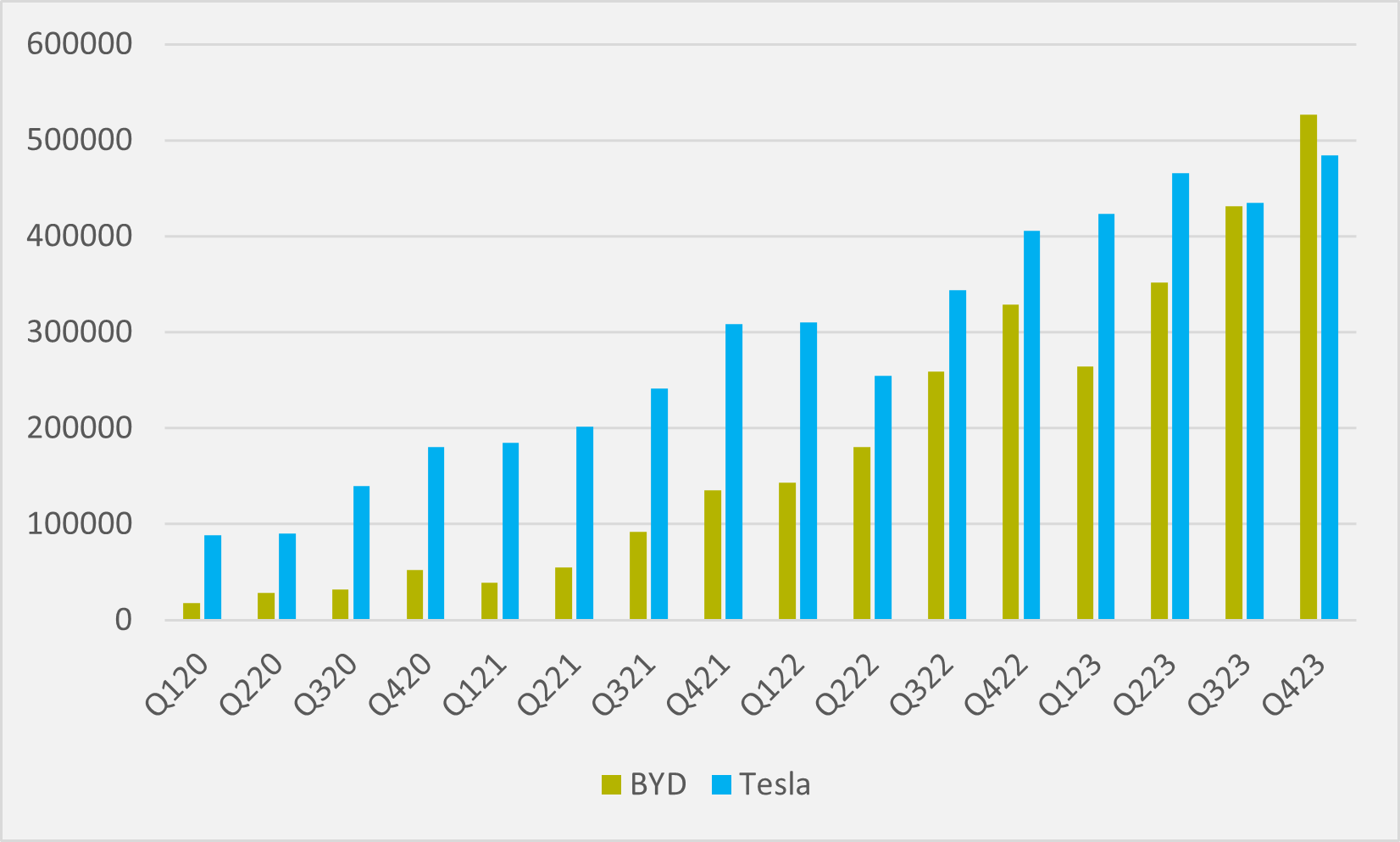

As Chinese EV makers largely continue to ride a wave of rising domestic demand and expanding appetite in Asia-Pacific export markets, Tesla has had to at least temporarily surrender its crown as the undisputed global BEV sales leader (see Fig.1). But this is not to say that Tesla will not lead the industry in other arenas.

The automaker is hard at work diversifying its revenue streams, and its dominance in the US charging space is well documented. But the company is also priming its energy storage business to make an ever-growing contribution to its future performance.

"Utility-scale energy storage has vexed the industry for the last two decades. However, as of today, Tesla has fielded a commercially viable, profitable, utility-scale energy storage solution in its megapack product," says analyst and journalist Louis Stevens.

"Tesla megapack has, to at least some degree, solved the problem of utility-scale energy storage," he adds.

The megapack is a large stationary battery with a capacity of 3.9MWh/unit. And Tesla's revenue from its energy storage business was up by 40pc year-on-year in Q3’23 at $1.56bn. This is still below the revenue generated by the automaker's charging business — but energy storage revenue is growing faster rate than charging, which grew by only 32pc in the same period.

"Regarding energy storage, we deployed 4GWh of energy storage products in Q3. And as this business grows, the energy division is becoming our highest margin business. Energy and service now contribute over $0.5bn to quarterly profit," CEO Musk said at the company's Q3 results.

Tesla Energy has scored a string of recent wins, spearheaded by megapack batteries. It recently installed 158 LFP megapacks in Oahu in Hawaii, replacing the state's last coal power plant. As of December, the firm also has over 300MWh of megapack capacity across nine sites in Alberta, Canada.

Tesla also makes smaller-scale storage devices, but it is the utility-scale megapack that is driving growth in the company's energy division. While the firm currently says it has deployed more than 10GWh in megapack capacity, Stevens sees Tesla able to hit the much greater ambitions it has for the business.

"I believe Tesla megapack will achieve the quite lofty 1,500GWh goal that CEO Elon Musk has set for the business in the decade ahead," Stevens says.

Tesla currently sells its highest-cost megapack for around $550/kWh of capacity. Even assuming a potentially conservative scenario of 1,000GWh annual megapack production capacity, this leads Stevens to calculate that "1,000GWh/yr in production at $550/kWh equals $550bn in approximately 25pc gross margin energy deployment revenues".

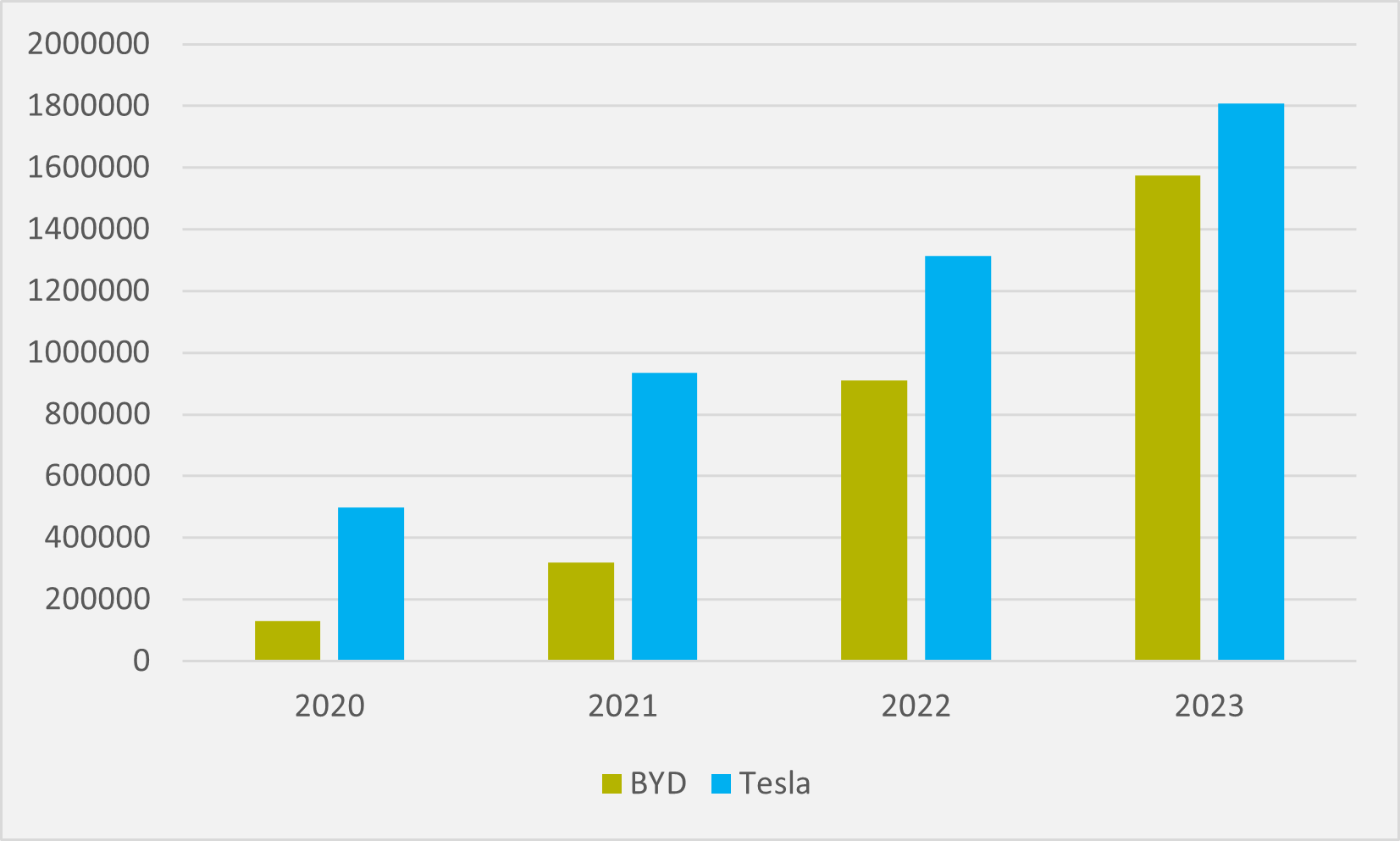

It is odd if markets are punishing Tesla stock simply for trailing BYD in sales for a single quarter, particularly given it outsold its Chinese rival over the year as a whole (see Fig.2).

Q4 was still Tesla's strongest ever quarter for vehicle sales — and that is without considering its auxiliary revenues in energy storage or the roughly 9pc of Tesla revenue that comes from the company's services division, which includes its supercharger business.

And these, energy storage in particular, should not be underestimated, in Stevens’ view. "I believe that it should be overemphasized that Tesla Energy is arguably the most important component of the Tesla thesis today outside of the FSD platform's long-term success," he suggests.

Insider Focus LTD (Company #14789403)